Nvidia (NVDA) stock’s recent surge has made market history, reaching a $3.6 trillion market cap as the first company to do so. This figure reflects the total value of a company’s outstanding shares. NVDA stock has been on a winning streak for months. However, Donald Trump’s recent victory has sparked additional momentum, as his anti-regulatory policies are expected to significantly benefit Big Tech companies.

What’s Happening with Nvidia Stock Today?

Despite some pre-market volatility and negative momentum, Nvidia stock has had an overall excellent week. It closed trading yesterday up 2%, continuing a week of steady growth that has pushed shares up 9% over the past five days. NVDA stock struggled in early September, causing speculation of an overly inflated valuation. However, the company’s historic new market cap indicates that Nvidia’s reign as a market leader is far from over.

This new $3.6 trillion valuation puts Nvidia above all its Big Tech peers, including Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL). While the recent momentum can be attributed to Trump’s victory, it is important to note that Nvidia has been growing for months. As the graphic above shows, it has risen 42% over the past three months, despite its early September declines. This demonstrates a clear ability to overcome challenging market conditions and sustain growth.

As a strong company operating in a booming market, Nvidia would likely have performed well under either Trump or Vice President Kamala Harris. However, with an incoming presidential administration that will likely roll back regulations on Big Tech, NVDA stock will face even fewer obstacles, setting the stage for further growth in the coming years.

Wall Street Is Highly Bullish on NVDA Stock

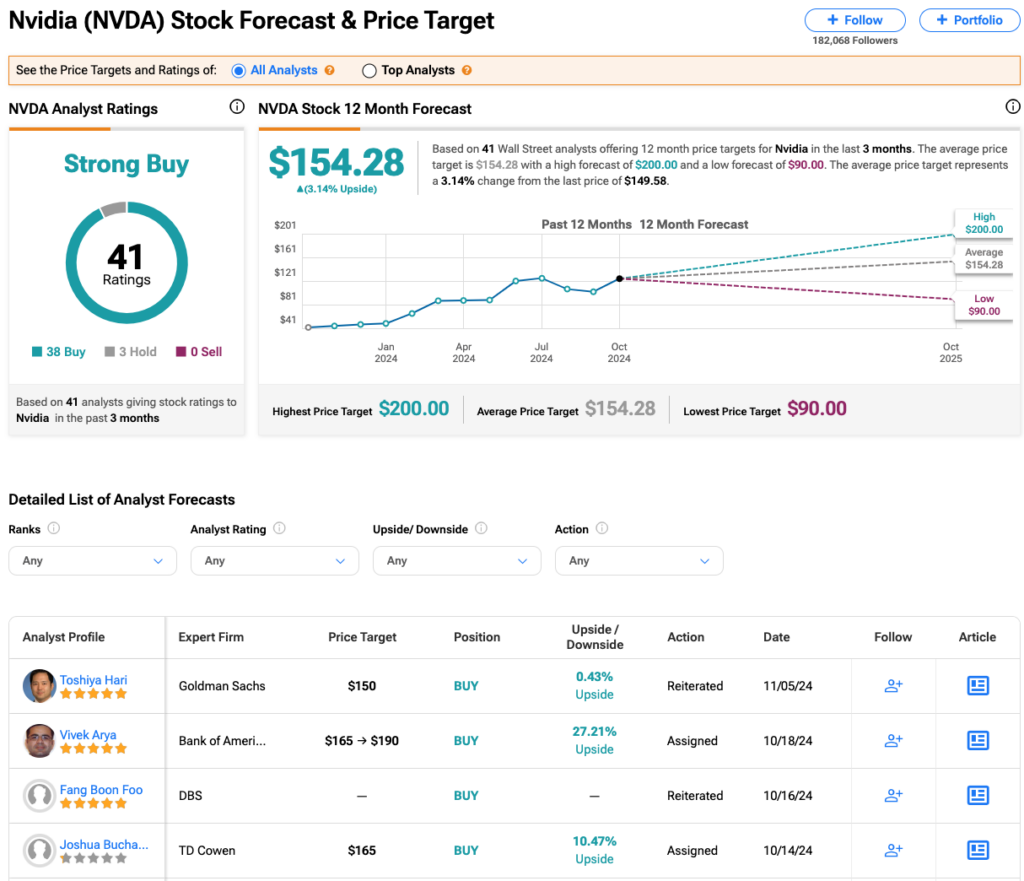

For these reasons Wall Street remains highly bullish on Nvidia. Analysts have a Strong Buy consensus rating on NVDA stock based on 38 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 218% rally in its share price over the past year, the average NVDA price target of $154.28 per share implies 3% upside potential.