Shares of chip maker Nvidia (NASDAQ:NVDA) surged on Tuesday to make it the most valuable listed company in the U.S. by surpassing tech giants Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL). The stock closed at a record high of $135.58 per share, which equals a market value of $3.34 trillion. This milestone marks the first time since early 2019 that a company other than Microsoft or Apple has topped the list. The surge in Nvidia’s valuation is due to the high demand for its artificial intelligence chips.

Not surprisingly, Interactive Brokers (NASDAQ:IBKR) reported a large increase in trading activity for Nvidia. In fact, over the past five trading sessions, Nvidia recorded 571,300 trades, surpassing even Tesla’s activity. This surge in trading volume was likely caused by the company’s 10-to-1 stock split, which made Nvidia’s shares more accessible to retail investors.

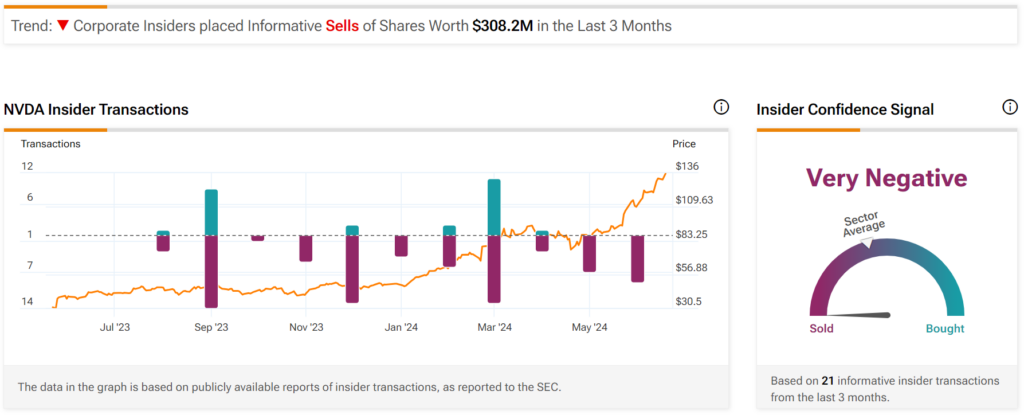

Insiders Continue to Sell NVDA Shares

It’s worth mentioning that while investors continue to pile into Nvidia, insiders have sold over $700 million worth of shares this year and $308 million during the past three months as they look to take advantage of the company’s record rally. CEO Jensen Huang was among those who sold shares, with a notable transaction worth over $31 million in June. Nevertheless, the strong demand for Nvidia’s AI chips continues to drive its stock price higher as investors overlook these transactions.

What Is the Target Price for NVDA Stock?

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 37 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 209% rally in its share price over the past year, the average NVDA price target of $126.88 per share implies 6.42% downside risk.