Technology company NVIDIA Corporation (NVDA) recently announced the launch of its comprehensive software suite of AI tools and frameworks, NVIDIA AI Enterprise.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the news, shares of the company declined marginally to close at $216.51 in extended trade on Tuesday.

With the launch of NVIDIA AI Enterprise, companies running VMware vSphere will be enabled to virtualize AI workloads on NVIDIA-Certified Systems. IT professionals using VMware vSphere that operates traditional enterprise applications will be able to easily and cost-effectively support AI workloads with the same tools that they use to manage large-scale data centers and hybrid clouds.

The Head of Enterprise Computing at NVIDIA, Manuvir Das, said, “Today is the beginning of a new chapter in the age of AI, as NVIDIA software brings its transformative power within reach for enterprises around the world that run their workloads on VMware with mainstream data center servers.” (See NVIDIA stock chart on TipRanks)

Recently, Benchmark Co. analyst David Williams initiated a Buy rating on the stock with a price target of $230. The analyst’s price target implies upside potential of 5.5% from current levels.

According to the analyst, the company’s robust second-quarter results give it a strong footing. Moreover, the analyst sees sustained strength in the gaming and data center space, which bodes well for the company in the long run. Finally, the analyst opines that the company’s new software platforms are expected to drive its core business growth.

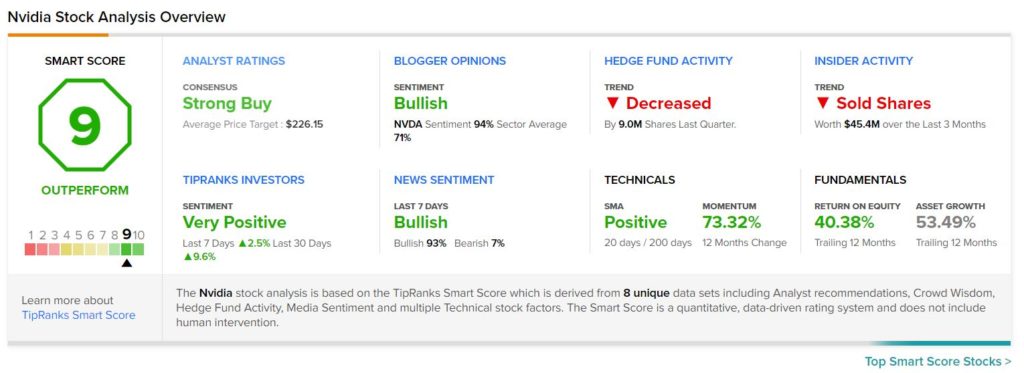

Consensus among analysts is a Strong Buy based on 29 Buys, 1 Hold and 1 Sell. The average NVIDIA price target of $226.15 implies upside potential of 3.8% from current levels.

NVIDIA scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 70.9% over the past year.

Related News:

Mr Cooper to Sell Xome Valuations Business for $15M

Camping World Doubles Quarterly Dividend; Shares Soar 7% in Pre-Market

Cigna Enters Accelerated Stock Repurchase Agreements Worth $2B