The rise of a new AI competitor, China-based startup DeepSeek, sent shockwaves through the global stock markets on Monday. The news led to a drop in several major AI stocks, particularly Nvidia’s (NVDA) which fell about 17% yesterday. This triggered a sharp decline in the prices of several exchange-traded funds (ETFs) with significant exposure to NVDA stock.

To explain the market turmoil, DeepSeek revealed that its AI models were trained at just $5.6 million, a fraction of what U.S. tech companies have spent. Additionally, DeepSeek’s AI chatbot has surpassed ChatGPT in downloads on the Apple (AAPL) App Store, with its technology being reportedly faster. These developments have raised concerns about growing competition in the AI industry and the potential impact on the profitability of major tech companies.

Nvidia’s Crash Hits ETFs Hard

The news triggered a domino effect, that particularly hurt leveraged ETFs tracking Nvidia’s performance. For instance, the GraniteShares 1.5x Long NVDA Daily ETF (NVDL), which aims to double Nvidia’s daily returns, fell by nearly 34%.

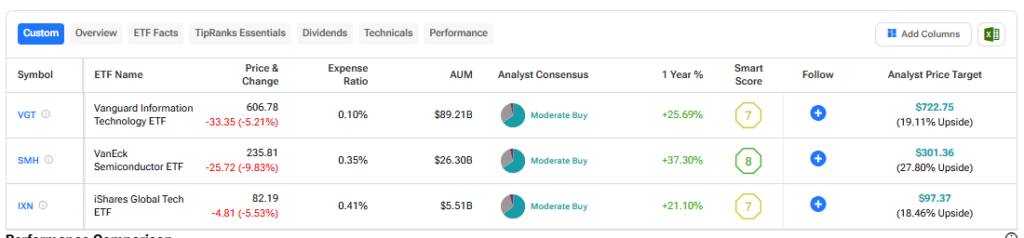

While leveraged ETFs were most severely impacted, other ETFs with significant exposure to Nvidia, such as the Vanguard Information Technology Index Fund (VGT), with nearly 15% of its assets in Nvidia, saw a 5.2% decline. Similarly, the VanEck Semiconductor ETF (SMH), with 19.4% Nvidia exposure, was down about 10%. Also, the iShares Global Tech ETF (IXN), with 18.3% exposure to NVDA, declined 5.5%.

Which Is the Best ETF to Buy Right Now?

While the initial reaction was dramatic, analysts believe this is a temporary setback. They contend that the AI landscape continues to evolve, and competition will drive innovation and further advancements. This is expected to keep supporting the tech stocks and the ETFs with exposure to them.

Among the above-mentioned ETFs, VGT, IXN, and SMH, all have a Moderate Buy consensus rating. Looking ahead, analysts forecast the highest upside potential of 27.8% for SMH stock.