AI has been generating headlines as well as enhanced computing capabilities in recent months. Since the advent of generative AI with the launch of ChatGPT in 2022, the new technology has been taking the tech world, and the broader economy, by storm. AI’s impact has been felt in everything from supercomputing and semiconductor chip making to graphic design and language translations.

This is opening up new opportunities for investors, and a look at some numbers will show just how expansive those opportunities are. According to the market analysis company Grand View Research, the AI market may hit $1.8 trillion by 2030, a far cry from its $137 billion value in 2022. Meanwhile, investment firm Wedbush predicts that AI spending will make up between 8% and 10% of IT budgets by the end of this year.

No investor can ignore a sector that drips money as copiously as this, and AI stocks are reaping the benefits of increased investor interest.

Against this backdrop, leading analysts from Argus have pinpointed Nvidia (NASDAQ:NVDA) and Palantir (NASDAQ:PLTR) as prime investment opportunities within the AI sector. Are these views widely shared? We turn to the TipRanks database for insights. Let’s delve deeper.

Nvidia

We’ll start with Nvidia, the semiconductor chip maker whose meteoric rise in share price has reflected its strength in the AI-capable processor chip market. AI systems depend heavily on graphic processor units, high-capacity semiconductor chips capable of supporting the extensive, rapid computing functions that AI demands. Nvidia was the original developer of these chips, which were originally used to support the high-end graphics demand by computer gamers. Against this background, Nvidia’s stock has jumped an impressive 194% over the past 12 months.

The hefty surge in Nvidia’s stock price has also pushed the company into the very top stratum of the public markets. Nvidia currently boasts a market cap of nearly $3.25 trillion, making it one of just three $3 trillion-plus firms.

By the first week in June, Nvidia stock was trading well above $1,100 per share, prompting the company to enact a 10-for-1 stock split that was made effective on June 7. The split effectively brought down the share price, which is now standing above $120.

Nvidia reported its fiscal 1Q25 results last month and beat the forecast across the board. The company’s top line, $26 billion, was up 262% year-over-year and was $1.45 billion better than the estimates. At the bottom line, Nvidia had a non-GAAP EPS of $6.12, 54 cents per share better than had been anticipated. The company’s overall success was powered by record results in the Data Center segment; this business segment brought in $22.6 billion of the revenue total, for a 427% year-over-year gain.

For Argus’ Jim Kelleher, a 5-star analyst rated in the top 1% of the Street’s stock pros, the key here is Nvidia’s recent record of success and its potential to keep delivering that success going forward.

“Following a highly successful FY24, Nvidia, in our view, is positioned for continued momentum in FY25. The NVDA shares have much further to go, given the company’s positioning within transformational AI technology. We recommend establishing or adding to positions in this preeminent vehicle for participation in the AI economy. We believe that most technology investors should own NVDA in the age of deep learning, AI, and GPU-driven applications acceleration,” Kelleher opined.

The top analyst goes on to put a Buy rating on NVDA shares, with a $150 price target that implies room for a one-year upside of 18.5%. (To watch Kelleher’s track record, click here)

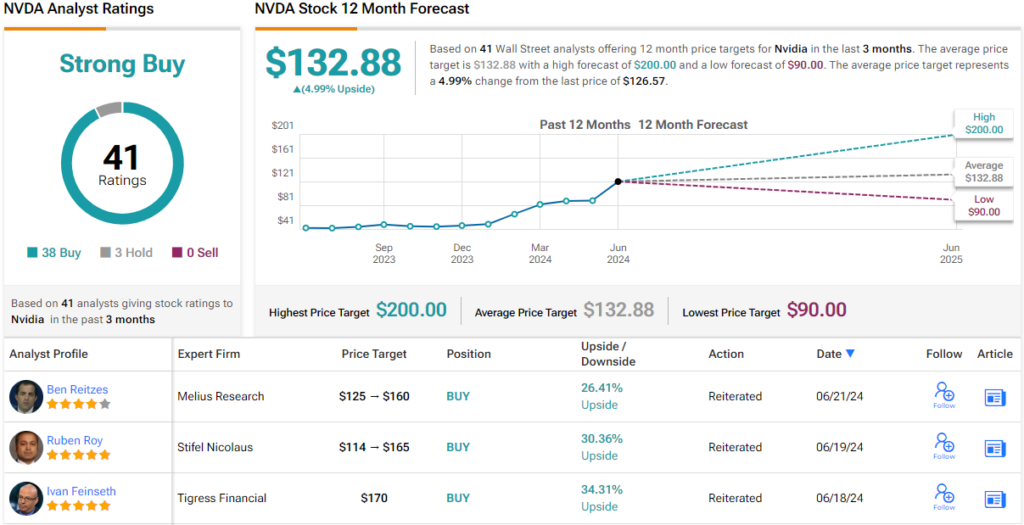

Overall, NVDA has picked up no fewer than 40 analyst reviews recently, and the lopsided 37 to 3 split favoring Buys over Holds gives the stock its Strong Buy consensus rating. Yet, the average price target stands at $132.88, suggesting a modest 5% upside from current levels. (See NVDA stock forecast)

Palantir Technologies

The second stock we’ll look at is Palantir Technologies, one of the tech world’s leading data analysis companies. The company, which started out as a creation of the well-known billionaire Peter Thiel, has been in operation for 21 years. Palantir’s founding purpose was to combine the best of data analytics with human intuition, to reap the benefits of both. This mission was tailor-made for AI, and Palantir makes use of AI to power its basic data applications.

In fact, AI stands at the center of Palantir’s work and activities these days. The company uses AI to augment the intelligence of human operators, providing a range of data analysis apps and platforms for its customers. Palantir’s flagship AI platform, the AIP, permits users to interface with the system using natural language – there is no need for purpose-written computer scripts or complex coding languages. The AI can return results using ordinary language, giving nuanced answers to user queries, with high levels of detail and data analysis that is accessible to the layman.

Like Nvidia, Palantir has benefited greatly from the recent rapid expansion of AI technology, particularly of generative AI capable of mimicking human expression. Some recent announcements from the company underscore this fact.

At the end of May, Palantir announced that it had been selected for a Department of Defense contract worth $153 million initially, with additional awards up to $480 million possible over the next five years. The contract is intended as a step toward integrating AI technology into the DOD’s ability to make better and faster decisions.

The Defense Department contract was followed in June by an important civilian contract, an agreement with Tampa General Hospital to provide core analytics and an AI platform. The aim is to use AI to power workflow coordination for greater efficiency and improved allocation of resources.

Given all of this, it should be no surprise that Palantir’s top and bottom lines have been trending upwards in recent quarters. The company reported 8 cents per share in non-GAAP earnings for 1Q24, in line with the forecast and significantly higher than the 5-cent EPS reported in the prior year period. At the top line, the company’s revenue of $634 million was up more than 20% year-over-year – and was $16.72 million better than the estimates. In a metric that bodes well going forward, Palantir reported a 42% year-over-year increase in its customer count during Q1.

Joseph Bonner, a 5-star analyst at Argus, is bullish on Palantir, highlighting its strong commercial prospects as a key driver of future growth.

“While Palantir has long served the needs of the U.S. defense and intelligence community, the company has expanded into the commercial sector with data management and analytics platforms capable of providing solutions to complex business problems. The company’s government business generated 55% of revenue in 2023. While we expect this segment to continue to grow, the commercial business, particularly in the U.S., looks to be its future growth driver. Like many enterprise software companies we cover, Palantir is reliant upon new AI-powered applications to expand its business,” Bonner explained.

Bonner’s Buy rating on PLTR stock is complemented by a $29 price target that implies a one-year upside potential of ~22%. (To watch Bonner’s track record, click here)

While Bonner’s outlook is optimistic, the broader consensus among analysts leans towards a Hold (i.e. Neutral) rating based on 6 Hold, 4 Sell, and 4 Buy recommendations. The average price target currently stands at $22.55, indicating a potential downside of ~5% from the current share price of $23.84. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.