California-based Nurix Therapeutics (NRIX) is focused on developing treatments for cancer and other diseases. It has several product candidates at various stages of development. (See Analysts’ Top Stocks on TipRanks)

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Let’s take a look at the company’s latest financial performance, corporate updates, and newly added risk factors.

Fiscal Q3 Financial Results

Nurix Therapeutics reported revenue of $10.3 million for its Fiscal 2021 third quarter ended August 31. That compared to revenue of $4.1 million in the same quarter last year. Nurix currently relies on collaboration activities as its primary sources of revenue. It has collaboration arrangements with Sanofi (SNY) and Gilead (GILD).

The company posted a loss per share of $0.65, compared to a loss per share of $1.09 in the same quarter last year. Nurix ended Q3 with $465.4 million in cash.

Corporate Updates

Nurix Therapeutics has initiated a Phase 1 clinical study of its NX-1607 drug candidate for cancer patients. It is conducting the study at multiple sites in the U.K. to assess the safety and tolerability of the candidate. Nurix now has two drug candidates in clinical trials. The other is NX-2127.

The company is preparing to begin clinical trials of its two other dug candidates, NX-5948 and DeTIL-0255, in the second half of 2021.

As it expands its clinical programs, Nurix Therapeutics is also strengthening its board. The company recently added former Johnson Controls International executive Judith A. Reinsdorf and former Vertex Pharmaceuticals executive Paul M. Silva to its board. It described them as experienced business leaders.

Risk Factors

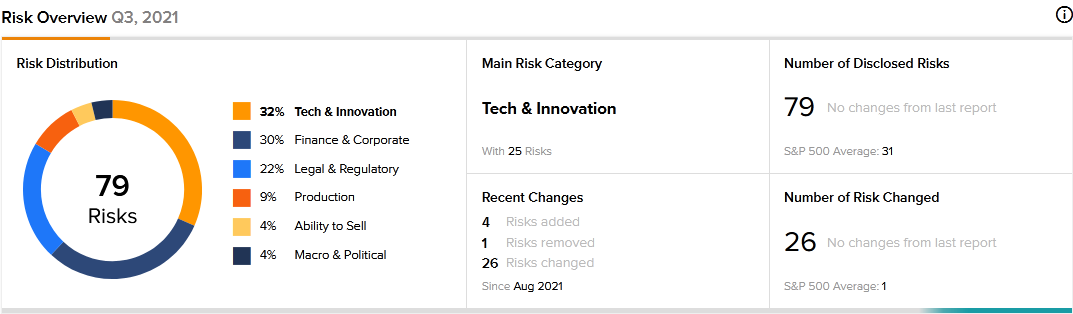

A total of 79 risk factors have been identified for Nurix Therapeutics, according to the new TipRanks Risk Factors tool. Since August 2021, the company has updated its risk profile to add four new risk factors.

Nurix Therapeutics cautions that failure to obtain approval for its drug candidates under the FDA’s Accelerated Approval Program could increase its expenses and delay the marketing launches of its products.

The company warns that its drug sales may be adversely affected if the FDA approves generic versions of its drugs.

Nurix Therapeutics tells investors that policy changes at the FDA could prevent or delay marketing approvals for its drug candidates.

The majority of Nurix Therapeutics’ risk factors fall under the Tech and Innovation category, with 32% of the total risks. That is above the sector average of 26%. The company’s stock price has declined about 14% year-to-date.

Analysts’ Take

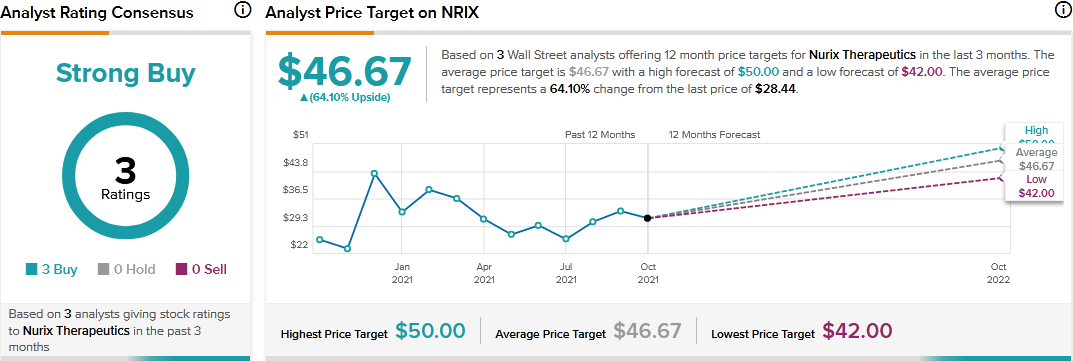

Needham analyst Gil Blum recently reiterated a Buy rating on Nurix Therapeutics stock with a price target of $48. Blum’s price target suggests 68.78% upside potential.

Consensus among analysts is a Strong Buy based on 3 Buys. The average Nurix Therapeutics price target of $46.67 implies 64.10% upside potential to current levels.

Related News:

CDW to Acquire Sirius Computer Solutions for $2.5B

Equinix, PGIM Real Estate Join Hands to Develop & Operate Data Centers in Sydney

Avalara Acquires CrowdReason; Street Says Buy