The stellar performance of Palantir (NYSE:PLTR) over the past year has placed the stock in good company. Starting next Monday, PLTR will be included in the S&P 500 as part of the index’s quarterly rebalancing.

This achievement follows a streak of robust growth for the big data analytics firm. Palantir has posted profits for seven straight quarters, with its latest 2Q24 results showcasing an impressive 80% year-over-year earnings growth.

Unsurprisingly, the stock is up by 135% over the past 12 months. However, at least one investor, Amritha Roy, thinks that the stock has overheated and that now is the time to head for the exits.

“Given where Palantir is currently trading, I believe that there is more downside than upside in the short term,” writes Roy.

The investor believes that Palantir is by far the most richly valued SaaS company. While not dismissing its growth potential in the coming year, Roy remains skeptical that the current risk-reward balance makes it a compelling investment at this time.

In addition, while being added to the S&P 500 has historically driven share price increases, Roy points out that these gains tend to fade away after a few months.

Other sources of concern include the (relatively) slower growth of Palantir’s international business, which comprises slightly over a third of company revenues.

Moreover, the broader macroeconomic environment presents another challenge as any slowdown in enterprise AI spending could lead to tougher times for PLTR.

Roy also emphasizes that insider Peter Thiel’s plans to sell $1 billion worth of PLTR shares could put additional downward pressure on the stock.

“Investors may want to trim or sell their positions to book profits at these current levels to avoid the volatility punch ahead,” the investor summed up.

With these risks in mind, Roy has placed a Sell rating on PLTR shares. (To watch Roy’s track record, click here)

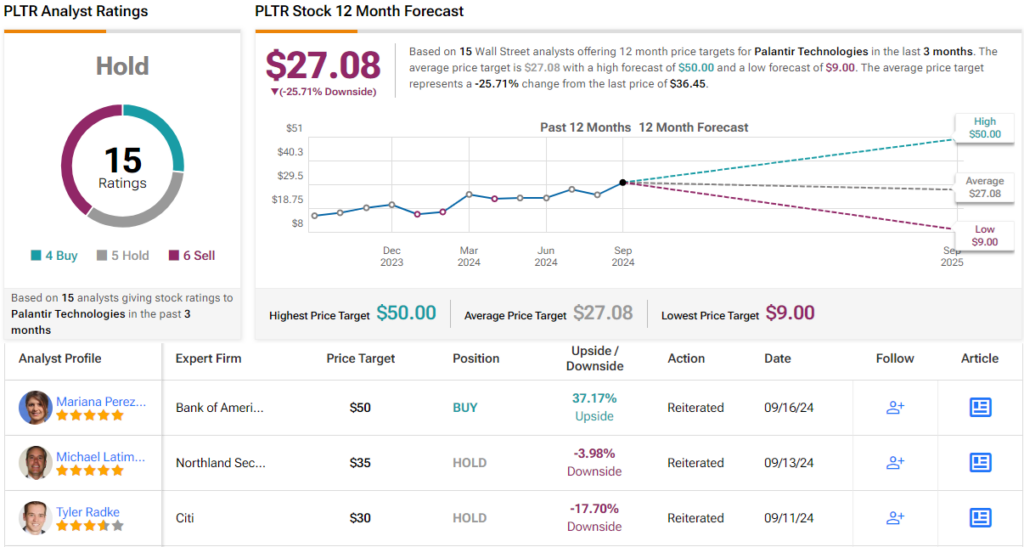

Overall, Wall Street’s analysts appear to echo Roy’s lukewarm outlook. With 4 Buy, 5 Hold, and 6 Sell recommendations, Palantir has a consensus Hold rating. The 12-month average price target of $27.08 implies potential losses of ~26%. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.