Danish pharmaceutical company Novo Nordisk (NYSE:NVO) announced that its controlling shareholder, Novo Holdings, will acquire global contract development and manufacturing company Catalent (NYSE:CTLT) for $16.5 billion, a price of $63.50 per share.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In addition, Novo Nordisk will acquire three Catalent fill-finish sites from Novo Holdings after the merger closes for an upfront payment of $11 billion. These three manufacturing sites are specialized in the “sterile filling of drugs” and are located in Italy, Belgium, and Indiana, U.S.

Shares of Catalent surged in pre-market trading following the news. Novo Nordisk’s purchase price is at a 16.5% premium to the closing price of Catalent’s common stock as of February 2, 2024.

This acquisition is expected to have a “low single-digit negative impact” on NVO’s growth in operating profit in FY24 and FY25 and is likely to close by the end of this year. Novo Nordik’s management expressed excitement about partnering with Catalent, as the acquisition aligns with the company’s life sciences investment strategy.

Is Catalent a Good Investment?

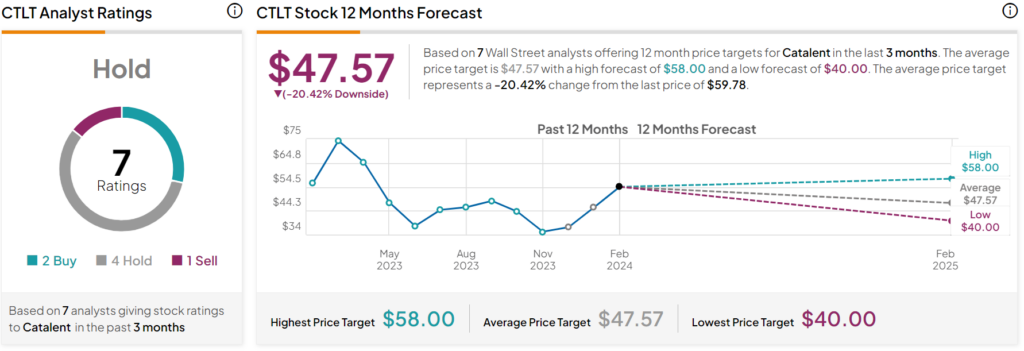

Over the past year, CTLT stock has dropped by more than 15%. Overall, analysts remain sidelined about CTLT with a Hold consensus rating based on two Buys, four Holds, and one Sell. The average CTLT price target of $47.57 implies a downside potential of 20.4% from current levels if the acquisition doesn’t close.