Ozempic-maker Novo Nordisk (NYSE:NVO) is planning another production plant in the U.S. amid persistent drug shortages. The Danish pharmaceutical major also secured a key approval in China this week. Meanwhile, competition may be about to heat up in the lucrative weight-loss market.

Robust demand for its weight-loss and diabetes offerings has pushed Novo Nordisk’s share price nearly 85% higher over the past year. The demand is so fierce that NVO is struggling to ramp up production in time, and the market is getting flooded with knock-off versions of NVO’s blockbuster drugs.

Novo’s New Plant

Consequently, NVO has been focused on expanding its production footprint. The company plans to set up another production facility in the U.S. with a $4.1 billion investment. The plant in North Carolina is expected to double NVO’s production presence in the U.S. So far, NVO has announced a $6.8 billion outlay for production capacity in 2024.

Major Approval in China

In another major development, NVO’s weight-loss medication Wegovy has secured approval in China. The approval could prove to be a substantial boost to NVO’s fortunes as China has the highest number of overweight or obese people in the world.

Competition Is Heating Up in the Weight-Loss Market

Meanwhile, NVO’s window of opportunity to cash in on the weight-loss craze may be getting narrower as new competitors emerge. Eli Lilly (NYSE:LLY) is already capitalizing on the demand with its Zepbound. Additionally, Pfizer (NYSE:PFE) is working on three new weight-loss products. According to Semafor, two of Pfizer’s drugs utilize the same GLP-1 technology as NVO’s Ozempic.

Is Novo Nordisk a Buy, Sell, or Hold?

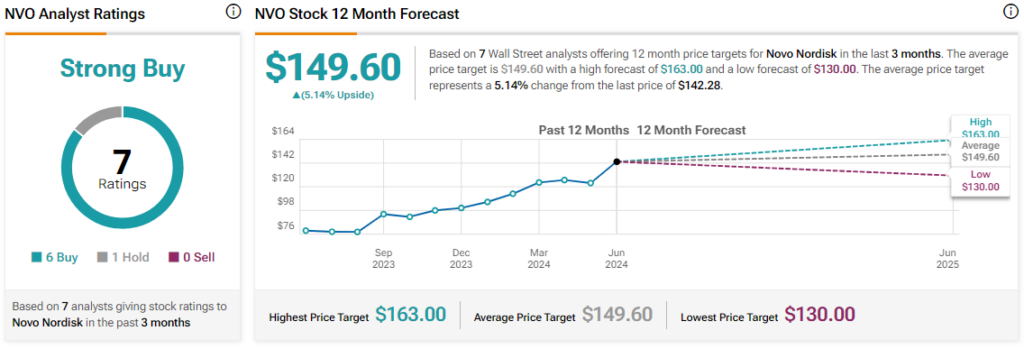

For now, though, the Street remains optimistic about Novo Nordisk with a Strong Buy consensus rating. The average NVO price target of $149.60, however, this points to just a modest upside potential in the stock.

Read full Disclosure