Biotech stock Novavax, Inc. (NASDAQ: NVAX) and Serum Institute of India Pvt. Ltd. (SII) revealed that Novavax’s recombinant nanoparticle protein-based COVID-19 vaccine with Matrix-M adjuvant has been authorized by the Drugs Controller General of India (DCGI) for emergency use. This time, the first protein-based vaccine has been approved for use in adolescents aged 12 to below 18 years in India.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The vaccine will be manufactured and marketed in India by SII as the brand name Covovax. SII is the world’s largest vaccine manufacturer by volume.

Supporting Data

The regulator’s approval was based on clinical results from the Phase 2/3 study, which demonstrated that the protein-based COVID-19 vaccine has well-tolerated and a favorable safety profile. The trial included 460 Indian participants in the age group of 12 to less than 18 years.

CEO’s Comments

Achieving this milestone, Novavax CEO Stanley Erck commented, “We hope that this authorization of our COVID-19 vaccine in adolescents is the first of many worldwide so that families have an additional choice built on a well-understood platform used in other vaccines for decades.”

Prior Approvals

In December 2021, Covovax received Emergency Use Authorization (EUA) for adults aged 18 years and above. Additionally, EUA for the vaccine was granted in Indonesia, the Philippines, and Bangladesh, along with Emergency Use Listing (EUL) from the World Health Organization.

Meanwhile, NVX-CoV2373 has not received authorization for use by the U.S. FDA (Food and Drug Administration).

Analyst Recommendations

Recently, Jefferies Group analyst Roger Song maintained a Buy rating and a price target of $198 (136.28% upside potential) on the stock.

The rest of the Street is cautiously optimistic about the stock, which has a Moderate Buy consensus rating based on five Buys and two Holds. The average Novavax price target of $179.86 implies 114.63% upside potential. Shares have lost 61.88% over the past year.

Risk Analysis

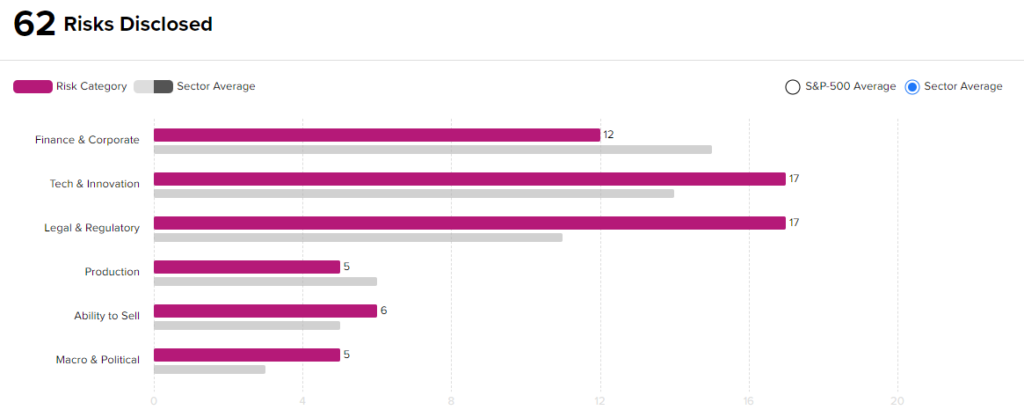

According to the new TipRanks Risk Factors tool, Novavax stock is at risk mainly from three factors: Tech and Innovation, Legal and Regulatory, and Finance and Corporate, which contribute 17, 17, and 12 risks, respectively. In total, 62 risks were identified for the stock.

Though Novavax is at a higher risk from a technical and a legal standpoint than other companies in its industry, it remains a financially sound company. Given its risk profile, recent positive clinical development, and current stock movements, investors might consider this an attractive entry point for the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

FDA Approves Bristol Myers Squibb’s Opdualag Therapy

Ford’s European Production to Take the Brunt of Macro Issues – Report

Anaplan Signs $10.7B Takeover Deal