Novavax, Inc. (NASDAQ: NVAX), one of the leading Biotech stocks, and SK bioscience, Co. Limited expanded their collaboration and license agreements for NVX-CoV2373, Novavax’s recombinant nanoparticle protein-based COVID-19 vaccine. Notably, SK bioscience is a vaccine business subsidiary of Korea-based SK Group.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Detailed Terms

Per the terms, SK bioscience will reserve additional capacity to manufacture antigen, a main component of NVX-CoV2373, through 2022. Notably, the previously announced advance purchase agreement (APA) between SK bioscience and the Korean government for the supply of 40 million doses of NVX-CoV2373 for the Republic of Korea remains in place.

Meanwhile, in 2022, additional quantities of the vaccine might be supplied by SK bioscience in the Korean market. Markedly, SK bioscience also has non-exclusive rights to sell doses of the vaccine to the governments of Thailand and Vietnam.

Official Comments

Novavax CEO Stanley C. Erck commented, “SK bioscience and the Korean government continue to be significant partners with Novavax in our efforts to ensure broad access of our COVID-19 vaccine to the citizens of South Korea and beyond. This strategic partnership helps to further expand our global network for manufacture and commercialization of high-quality product and will be an important part of our expected 2 billion annual doses in total global manufacturing capacity in 2022.”

Wall Street’s Take

Recently, B.Riley Financial analyst Mayank Mamtani reiterated a Buy rating and a price target of $305 (72.07% upside potential) on the stock.

Shares of Novavax have rallied 51.7% over the past year. The stock scores a Strong Buy consensus rating based on 3 Buys versus 1 Hold. The average Novavax price target of $270 implies 52.33% upside potential.

Risk Analysis

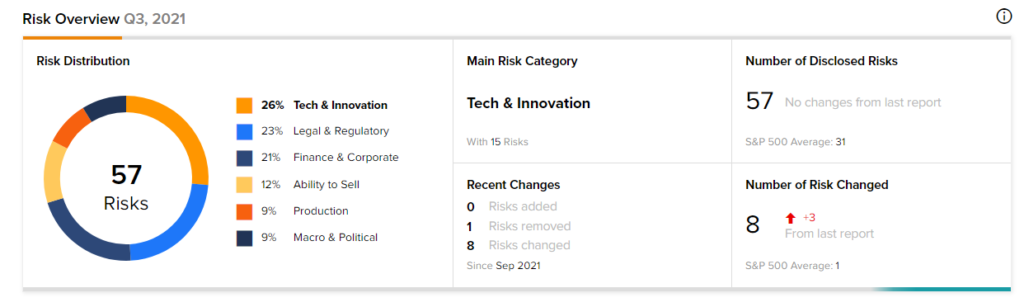

According to the new TipRanks Risk Factors tool, Novavax stock is at risk mainly from three factors: Tech and Innovation, Legal and Regulatory, and Finance and Corporate, which contribute 26%, 23%, and 21%, respectively to the total 57 risks identified for the stock.

Related News:

Citigroup to Vend Philippines Consumer Bank

Tencent to Reduce Stake in JD.com to 2.3%; Shares Slide

Quidel to Acquire Ortho for $6B; Shares Slide 17%