Novavax (NVAX) filed a prospectus to sell up to $250 million of shares of common stock as it prepares to scale up production of its coronavirus vaccine candidate.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Shares in Novavax jumped 31% to close at $56.96 in U.S. trading on Monday after their value more than doubled over the past month.

The late-stage biotech company, which is in the process of developing a coronavirus antigen vaccine candidate, said that the net proceeds from the sale of common stock will depend on the number of shares actually sold and the offering price for such shares. The company based its calculation on the event that all of the offered shares would be sold at $43.63, the closing price per share on May 15.

“We intend to use the net proceeds from this offering for general corporate purposes, including but not limited to working capital, capital expenditures, research and development expenditures, clinical trial expenditures, as well as acquisitions and other strategic purposes,” Novavax said in the prospectus filing.

The offering comes after Novavax announced last week that it will receive $384 million in funding from the Coalition for Epidemic Preparedness Innovations (CEPI) to develop and produce its coronavirus vaccine candidate. The biotech company has set itself the aim of producing up to 100 million vaccine doses by end of 2020. For 2021, it is planning to target large-scale manufacturing capacity in multiple countries with a goal of potentially producing over one billion doses during the year.

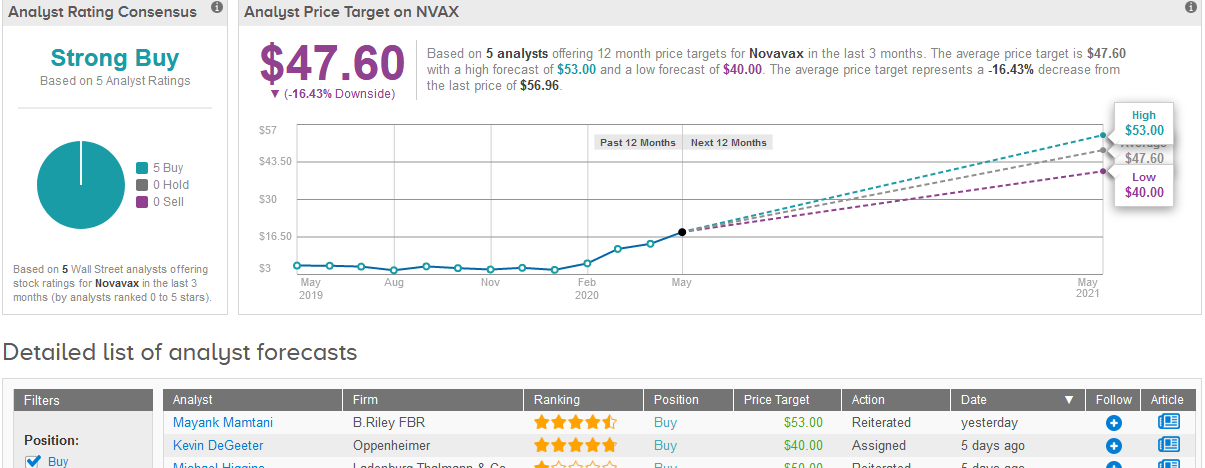

Five-star analyst Mayank Mamtani at B. Riley FBR on Monday raised his price target on the biotech stock to $53 a share from $43 and kept his Buy rating, following a meeting with Novavax management to review progress on on its COVID-19 vaccine development.

“We believe NVAX not only offers a clinically validated adjuvanted recombinant nanoparticle platform (recently reporting overwhelmingly positive data in the Ph. III NanoFlu) but, also, demonstrates the ability to illicit a potent immune response at extremely low doses, boding favorably for both safety and scalability, with management guiding to 100M doses by YE20 and >1B during 2021,” Mamtani wrote in a note to investors. “With a regulatory path becoming relatively clearer, likely on the basis of Ph. IIb results by leveraging Emergency Use Authorization (EUA), we increase the probability of success, from 25% to 40%, which drives our PT increase.”

The rest of Wall Street analysts covering the stock in the past three months join Mamtani in their recommendation to Buy the shares adding up to a Strong Buy consensus. Following the stock’s rally, the $47.60 average price target indicates 16% downside potential in the coming 12 months. (See Novavax stock analysis on TipRanks).

Related News:

Novavax Spikes 31% on $384 Million Cash Injection for Vaccine Production

AstraZeneca, Daiichi Get FDA Breakthrough Status For Gastro Cancer Drug

Seres Therapeutics Reports Weak Earnings, But Significant Upside Lies Ahead