Swiss pharmaceutical company Novartis (NVS) upgraded its mid-term guidance on Thursday. This saw the company increase its compound annual growth rate (CAGR) for sales from 2023 to 2028 to +6%. Before this, the company’s annual sales CAGR was +5%.

Novartis cites “strong momentum of in-market growth drivers” and “upcoming launches” as the reasons behind this upgrade. It also notes that most of its launches are expected to have U.S. exclusivity beyond 2030.

Novartis also updated its 2024 to 2029 sales CAGR to +5% alongside its mid-term guidance upgrade. Additionally, the company expects to hit core operating income margin of 40%+ by 2027. CEO Vas Narasimhan is also excited about the more than 30 assets in its pipeline that “support mid-single-digit growth post 2029.”

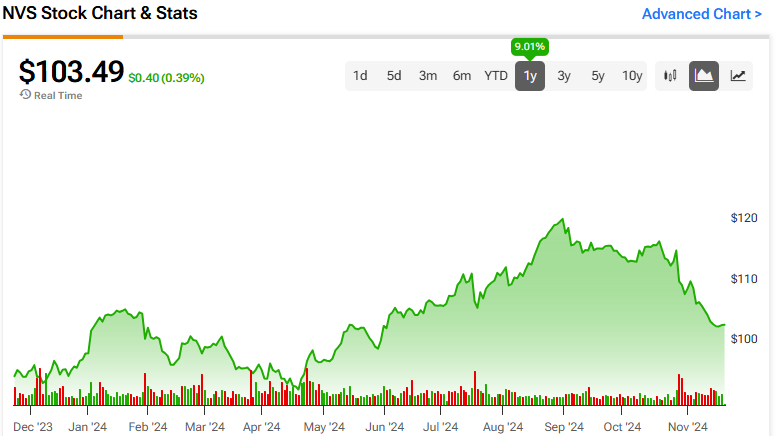

NVS Stock Performance

NVS stockholders reacted lukewarmly to today’s guidance update. As a result, the company’s shares only slightly increased as of Thursday morning.

Looking back at the performance of NVS shares, they’ve increased 4.82% year-to-date. The stock is also up 9.01% over the last 12 months. This slow growth could be a sign that Novartis stock growth is starting to stall.

NVS Stock: Bulls Say, Bears Say

TipRanks’ Bulls Say, Bears Say, and Technical Analysis tools point toward a bearish outcome for NVS shares. This includes concerns that revenue growth is already priced into the stock’s value.

Looking at the Technical Analysis, the overall consensus is Sell with 14 Bearish, two Neutral, and six Bullish stances on the stock.

Is NVS Stock Worth Buying?

Turning to Wall Street, the analysts’ consensus rating for Novartis is a Hold based on six Hold ratings over the last three months. This comes with an average price target of $123.90, a high of $130, and a low of $120. That represents a potential upside of 19.88% for the shares.