With the price of gold soaring to new heights, many investors are looking for opportunities to add gold exposure to their portfolios. One option is to invest in a company like NovaGold Resources (NYSE:NG), which is developing what could potentially become one of the largest gold mines in the world. While the stock is speculative at present, this pure gold play holds the possibility of exposure to significant gold production for decades to come.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

NovaGold’s Pure Gold Play

NovaGold Resources focuses purely on the Donlin Gold project in Alaska, a joint venture with Barrick Gold. The two companies are equal partners on the project, which is significant in scale and could turn into one of the leading gold mines worldwide.

Donlin Gold is estimated to hold roughly 39 million ounces of gold, with a grade more than doubling the industry average for an open-pit project of 2.2 grams per tonne. The mine’s anticipated lifespan is estimated to exceed 27 years, with an average annual production of over 1 million ounces.

The current plan foresees Donlin Gold as a near-year-round producer for several decades, underlining this project’s considerable potential for the future. Additionally, the currently identified resources only cover about 5% of the total land package, suggesting further untapped potential.

NovaGold’s Recent Financials

The first quarter financial results for 2024 reported a net loss of $10.3 million, equivalent to -$0.03 per share. This was in line with previous quarters’ expenditures to get the mine permitted and prepared for development.

Looking ahead to the rest of fiscal year 2024, expenditures are forecasted to be $31.2 million. Of this, $14.3 million will be used to advance the Donlin Gold project, with the remaining $16.9 million allocated for general corporate and administrative expenses.

Despite the net loss, NovaGold’s financial status remains robust. As of February 29, 2024, its balance sheet shows $118 million in cash and term deposits. This financial strength positions the company favorably for further progress in the Donlin Gold project.

What is the Price Target for NG Stock?

The stock has been downward trending, losing over 67% over the past three years. However, it has jumped up over 13% in the past month and continues to demonstrate positive price momentum, trading above the 20-day (2.99) and 50-day (2.91) moving averages.

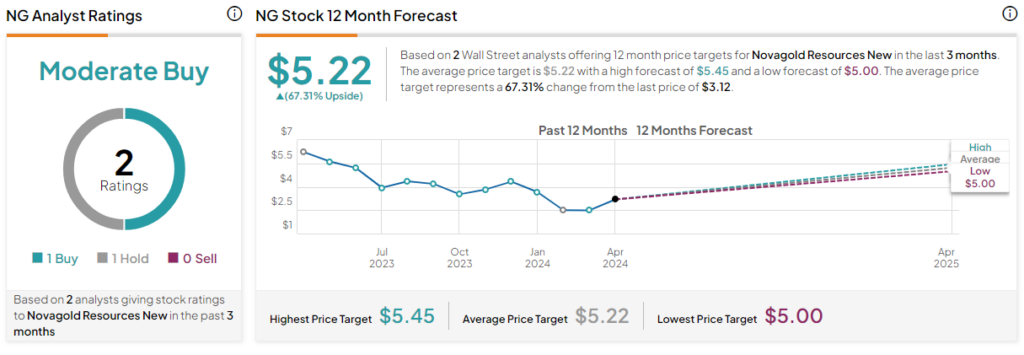

Analysts following the company have been cautiously optimistic about the stock. Based on the recommendations and 12-month price targets two Wall Street analysts assigned over the past three months, it is currently rated a Moderate Buy.

The average price target for NG stock is $5.22, which represents a 67.31% upside from current levels.

Final Thoughts on NG

The Donlin Gold Project’s potentially vast resources, projected lifespan of over 27 years, and potential for low-cost, year-round production underscore this endeavor’s immense potential for the future, making NovaGold an attractive investment opportunity despite its speculative nature. While the company is currently operating at a net loss, its solid financial standing goes a long way towards ensuring its capacity to advance the Donlin Gold project. The potential for significant and sustained gold production could make this a stock worth considering for those looking to add a pure gold play to their long-term holdings.