Northrop Grumman (NYSE:NOC) announced a considerable dividend hike a few weeks ago, reflecting promising future earnings potential. As a powerhouse in aerospace and defense, providing an array of crucial aircraft, weapons, and other systems, Northrop Grumman thrives in the current volatile geopolitical landscape. This latest dividend uptick is a testament to its ongoing momentum, which will likely persist, moving forward. Thus, I remain bullish on NOC stock.

Double-Digit Dividend Growth Comes Back

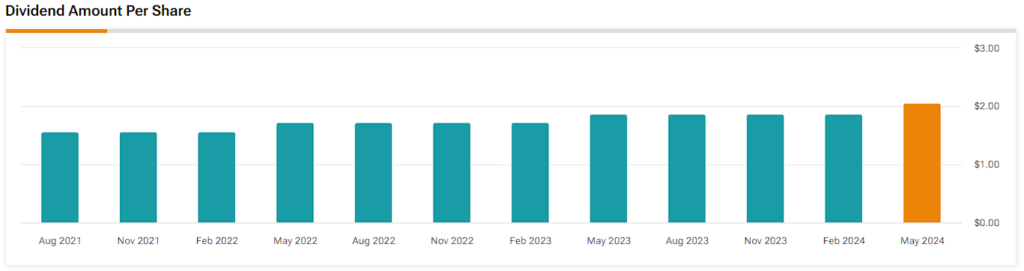

In mid-May, Northrop Grumman announced a double-digit dividend increase, this time by 10.2% to a quarterly rate of $2.06. This milestone not only signifies more than two full decades (21 years to be exact) of uninterrupted annual dividend increases but also represents a soft acceleration compared to last year’s hike of 8.1%.

I believe this is a signal from management that Northrop’s earnings growth prospects remain vigorous. Looking back, the company has consistently maintained a healthy payout ratio, typically ranging between 25% and 30% throughout the last decade. Therefore, it is reasonable to assume that the uptick in dividend growth reflects an anticipation of bolstered earnings growth in the foreseeable future. The company’s most recent quarterly report supports this view.

Robust Order Backlog Backs Strong Growth Across Every Segment

Northrop Grumman’s first-quarter results were quite strong. The company posted total revenues of 9% to $10.1 billion, boosting its numbers across every business segment. Overall, its results continue to be aided by a flourishing aerospace and defense industry, which currently benefits from growing military budgets. In turn, this reflects the lasting geopolitical unrest, including the ongoing war in Ukraine and the current events unfolding in the Middle East. Let’s take a deeper look at each segment.

Aeronautics Systems

Northrop’s Aeronautics System segment saw its sales rise by 18% in Q1 year-over-year. This increase was mainly due to a higher volume of restricted programs, a $114 million gain on the F-35 program (powered by a higher volume of maintenance and production contracts), and higher volumes of the E-2, Triton, and Global Hawk programs.

Defense Systems

Northrop’s Defense Systems segment posted sales growth of 3% during the period. Growth was mainly propelled by the acceleration of the Stand-in Attack Weapon (SiAW) program, volume growth of Guided Multiple Launch Rocket Systems (GMLRS), and some military ammunition and cannon systems programs.

These increases were partially offset by softer volume linked to the completion of an international training program. Yet, the deployment of such weapons systems in Ukraine is evidently leading to an increase in production volumes today as Western nations seek to replenish their arsenals.

Mission Systems

Mission Systems revenues experienced a 4% increase, primarily attributed to elevated restricted sales in advanced microelectronics programs, albeit tempered by reduced sales in the Scalable Agile Beam Radar (SABR) program.

Space Systems

Finally, Northrop’s Space System segment experienced a 9% increase in sales, driven mainly by a $117 million boost from the Space Development Agency’s Tranche 2 Transport Layer programs. Additionally, higher volumes in restricted programs, Commercial Resupply Services missions, hypersonics programs, and the Glide Phase Interceptor program contributed to this growth. However, this was partly offset by decreased Ground-based Midcourse Defense program volume.

Earnings & Valuation

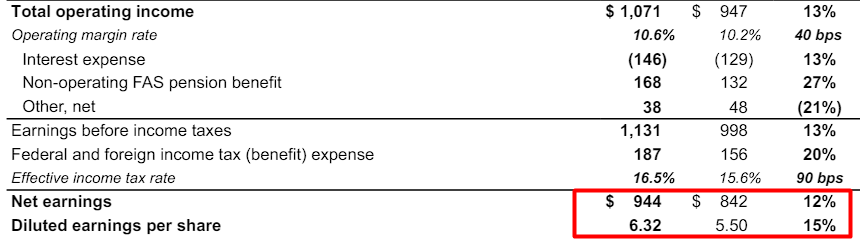

With Northrop sustaining top-line growth across every segment in Q1 and its margins benefiting from higher production volumes, the company’s earnings had an easy upward climb. Net earnings grew by 12% to $944 million, while earnings per share (EPS) grew by an even more notable 15% to $6.32, aided by a lower share count due to recent buybacks.

Management’s decision to raise the dividend by a double-digit rate reflects this notable growth in EPS. Is there a chance for EPS growth to slow down a bit throughout the rest of the year? There could be. Wall Street sees EPS of $24.78 for FY2024, implying a year-over-year increase of 6.4%.

However, even when employing this estimate, Northrop stock is still trading at a reasonable forward P/E of 17.8x. I think this is a fair multiple for the stock, especially given the company’s $78.9 billion backlog, which provides a noteworthy margin of safety.

Is NOC Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Northrop Grumman stock has a Moderate Buy consensus rating based on five Buys, five Holds, and one Sell assigned in the past three months. At $506.64, the average NOC stock price prediction suggests 16.3% upside potential.

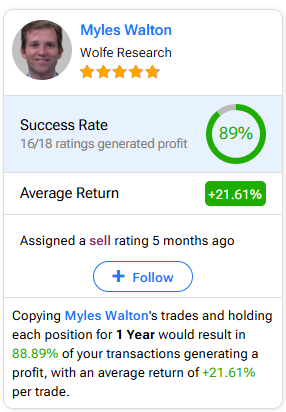

If you’re unsure which analyst you should follow if you want to buy and sell NOC stock, the most accurate analyst covering the stock (on a one-year timeframe) is Myles Walton from Wolfe Research, with an average return of 21.61% per rating and an 89% success rate.

The Takeaway

To sum up, Northrop Grumman’s latest double-digit dividend increase highlights its earnings potential and sustained momentum in the current environment, which is favorable for the industry. With a solid track record of dividend growth and strong results across all segments, it seems that management expects its ongoing, strong earnings growth trajectory to be maintained.

Even if EPS growth slows down later in the year, as Wall Street projects, the company’s overall prospects remain exceptional, backed by a huge order backlog. The stock also appears to be trading at a reasonable valuation, suggesting that Northrop’s overall investment case remains compelling.