Big investors are acquiring significant stakes in the railroad operator Norfolk Southern (NYSE:NSC), the Wall Street Journal reported. In response to this news, NSC stock jumped about 5.4% in Wednesday’s after-hours of trade.

A consortium led by the investment management firm Ancora Holdings has acquired an approximately $1 billion stake in the company. Additionally, hedge funds such as Sachem Head Capital Management and D.E. Shaw have acquired stakes in NSC. However, the exact size of their holdings remains undisclosed.

According to the report, Ancora Holdings plans a proxy fight with Norfolk Southern, seeking a board overhaul and the replacement of CEO Alan Shaw. The investor group led by Ancora seeks to gain control over the company’s Board and implement changes to improve its stock performance.

Norfolk Southern Stock Underperformed

Norfolk Southern is down about 3% over the past year, significantly underperforming the S&P 500 (SPX) gain of nearly 20%. A major derailment at the beginning of 2023, network disruptions, and a weak freight market have taken a toll on its financials. The company’s top line decreased by 5% in 2023, while adjusted EPS fell by 15%.

To reaccelerate growth, Norfolk Southern’s management is focusing on driving further productivity gains and operational efficiency through aggressive cost management. In light of this, NSC plans to cut 7% of its nonunion workforce.

Is Norfolk Southern a Buy or Sell?

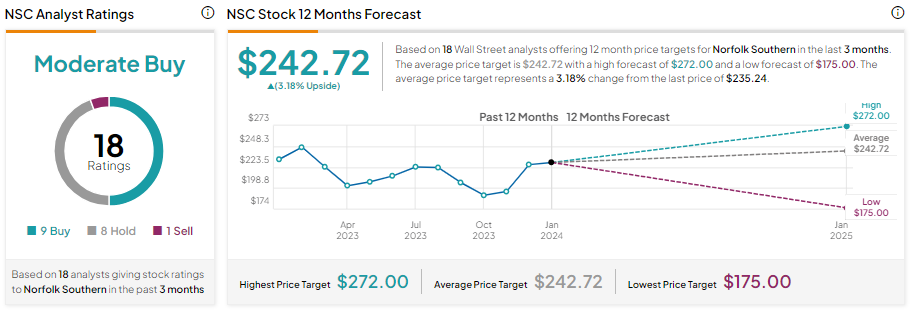

While the company is taking steps to improve its profitability, Wall Street analysts remain cautiously optimistic about its prospects.

Norfolk Southern stock has nine Buy, eight Hold, and one Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $242.72 implies 3.18% upside potential from current levels.