Nordstrom (JWN) reported its quarterly earnings on Friday, and the results were grim. Net sales dropped 40%, worse than the 33% decline expected by analysts.

The company recorded an operating loss of $521 million for the quarter for a loss per share of $2.23. This represented a decrease from net earnings of $37 million during the same period in fiscal 2019, and fell starkly short of Street expectations of a $0.95 loss per share for the quarter. Its shares closed on Friday at $16.13, down more than 12% for the day.

Nordstrom shuttered all of its stores on March 17. Some reopened in early May, while those in its key markets—California, New York and Washington—remain closed. Disappointingly, Nordstrom reported online-sales growth of only 5% in the quarter. As a result, Nordstrom reported that its SG&A expenses ballooned to 55% of net sales, compared with 34% of net sales for the same period in fiscal 2019.

The family-run retailer started the year well, experiencing sales growth in the fourth quarter after four consecutive quarters of negative year-over-year sales growth. It seemed that investments in e-commerce and a cautious approach to physical stores had helped Nordstrom stay ahead of the department store pack.

Nordstrom Rack — Nordstrom’s off-price unit — posted particularly weak numbers, partly because it initially was not able to to fulfill online sales through its stores. That capability was enabled by mid-April. Nordstrom’s reported that at the Nordstrom Rack locations that have reopened, sales have exceeded expectations thus far.

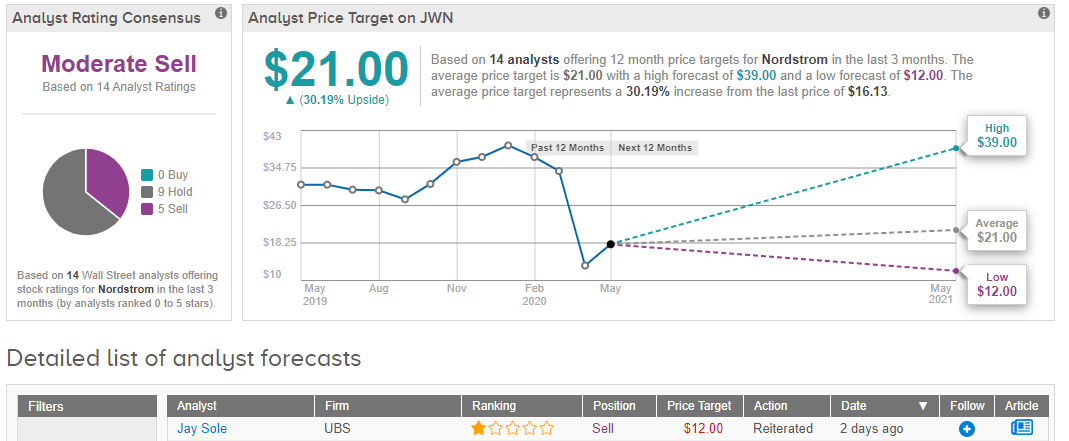

Even prior to Friday, it had been a brutal year for Nordstrom stock, having already dropped 56% year to date through Thursday. Analysts have a Moderate Sell consensus on Nordstrom and an average price target of $21 a share, although the poor results Nordstrom exhibited in the last quarter has pulled down the most recent price targets.

On Friday Jay Sole of UBS pulled down his price target to just $12. Nevertheless, the current price target of $21 represents 30% upside potential over the next 12 months. (See Nordstrom stock analysis on TipRanks).

Related News:

Papa John’s U.S. Pizza Sales Jump 33.5%; Shares Pop 7% In Pre-Market

Boeing Gets No Orders in April, Customers Cancel 737 MAX Jets

Alibaba Scores Earnings Beat With Revenue Surging 22% Y/Y