Shares of Nokia (NOK) rallied 7.3% in early trading on Thursday after the company reported robust Q2 2021 performance, which was driven by growth across all business units. The company provides network infrastructure, technology and software services.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Adjusted earnings came in at €0.09, up 50% from the last year’s quarter. Net sales increased 9% (on a constant currency basis) to €5.3 billion. The upsurge was primarily due to strong revenue growth in Network Infrastructure and Nokia Technologies units.

Adjusted gross margin was 42.3%, which compared favorably to 39.6% in the same quarter last year. Sales growth, favorable product mix and positive impact of a one-time software deal completed during the quarter led to the margin expansion.

Notably, the company was successful in controlling costs during the quarter, as reflected by 1% year-over-year fall in adjusted selling, general and administrative expenses. Research and development costs grew 6%. (See Nokia stock charts on TipRanks)

The President and CEO of Nokia, Pekka Lundmark, said, “We have executed faster than planned on our strategy in the first half which provides us with a good foundation for the full year.”

“In addition, we continue to accelerate R&D investments and monitor risks around component availability, considering the strong demand for our products,” he added.

Based on solid first-half performance, Nokia has raised its 2021 guidance for net sales to €21.7-22.7 billion from €20.6-21.8 billion previously expected. Also, adjusted operating margin is now anticipated to be in the range of 10 to 12%.

On July 13, Charter Equity analyst Edward F. Snyder reiterated a Hold rating on the stock. The analyst noted, “We expect stronger-than-expected performance in North America as customers other than Verizon will drive Nokia’s higher guidance for calendar year 2021 although its approach in China could diminish upside to margins.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus based on 9 Buys and 4 Holds. The average Nokia price target of $6.38 implies 9.8% upside potential to current levels.

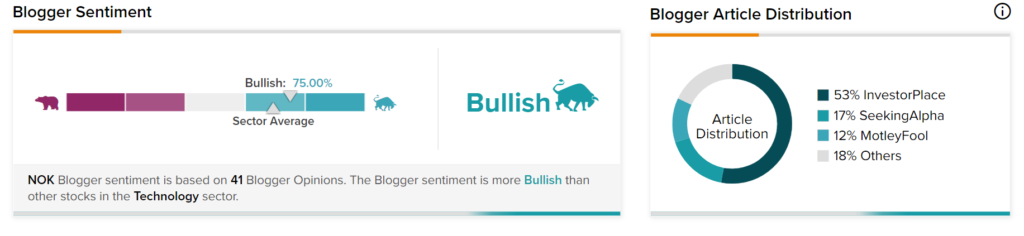

TipRanks data shows that financial blogger opinions are 75% Bullish on NOK, compared to the sector average of 69%.

Related News:

Microsoft Acquires AI-Based Spend Insights Provider Suplari

Walmart Makes In-House Technology Available to Retailers; Partners with Adobe

Spotify Posts Smaller Q2 Loss on Subscriber Growth; Shares Dip 3%