The day has finally arrived, and electronics giant Nokia (NYSE:NOK) has launched phase one of its big new share buyback program. Only recently announced, the deal would see a lot of Nokia shares repatriated back to within the company itself. Investors, however, proved only too willing to sell, and Nokia shares plunged nearly 5% in Monday morning’s trading.

Nokia launched its buyback just a little early, as repurchases were set to start on March 20. The program will reach its end by December 18, and overall, Nokia will not buy more than 300 million euros (about $326.133 million) before the program is concluded. At today’s share price, that’s close to 100 million shares of stock.

The first phase will see no more than 200 million shares repurchased—which is easy enough given Nokia’s current share price of around $3.50 per share and a ceiling of about $326 million—and represents a total of about 4% of all outstanding shares.

Falling Flat

It gets stranger from here. Not only did Nokia announce a buyback that fell flat, but it also announced a dividend, offering up 0.0325 euros (about $0.035) per share, payable on May 3. Yet, even as it offered all sorts of benefits for shareholders, the stock simply couldn’t keep up. What happened? Well, one possibility is that investors were put off by the buyback plan itself.

Just over two months ago, when it was first announced, the amount of the buyback was $653 million. Perhaps this is just the first phase, but it seems like the buyout’s missing a few hundred million from its original projections. And with word that Nokia is facing a rough 2024, that likely won’t help either.

Is Nokia Stock a Buy, Sell, or Hold?

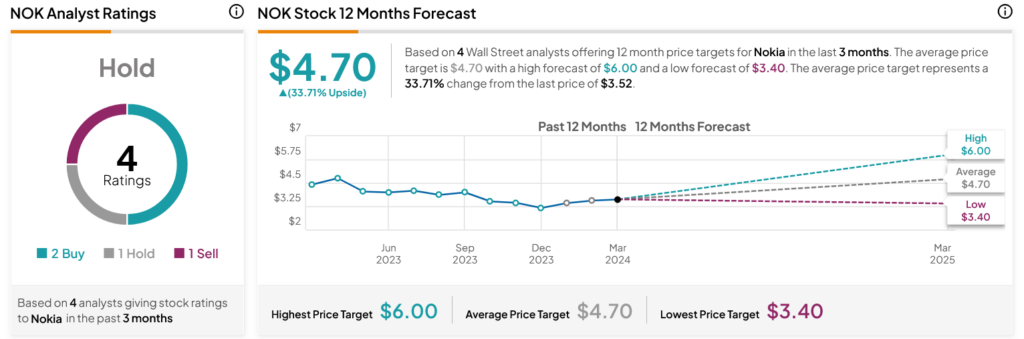

Turning to Wall Street, analysts have a Hold consensus rating on NOK stock based on two Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 21.08% loss in its share price over the past year, the average NOK price target of $4.70 per share implies 33.71% upside potential.