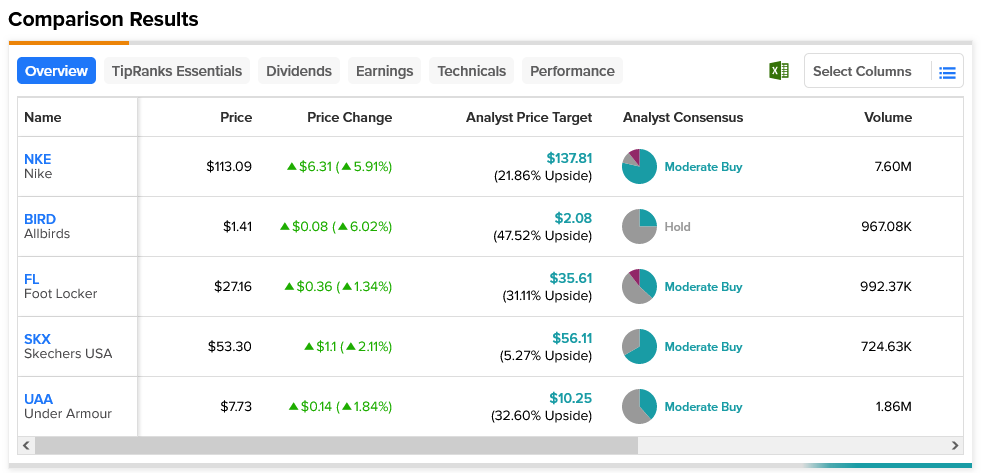

A good day for Nike (NYSE:NKE) proved to be a good day for a range of other footwear stocks as well. Allbirds (NASDAQ:BIRD) managed to do a little better than Nike in Wednesday afternoon trading, while Skechers (NYSE:SKX) made a good showing as well. Even Foot Locker (NYSE:FL) and Under Armour (NYSE:UAA) managed to make an upturn of things.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

So what gave Nike its leg up and started a slate of stocks in the footwear market to tick up as well? A combination of factors, starting with some Google trends data that showed a partial comeback in the making and a mall traffic report that suggested an even clearer bounce. Investors, not surprisingly, were looking at the landscape and believing that a cutback in discretionary spending was in the cards. That turned out not to be the case, and shoppers were making headway once more.

Mall traffic, based on a growing array of studies, is largely being impacted by a fundamental shift in just what a mall is and does. A study from Placer.ai back in 2022 showed that thriving malls were increasingly moving to entertainment options like casinos and theme parks, which helps improve time spent in a mall and traffic to shops. There’s also the matter of consumer debt to consider; it’s on the rise in a big way, passing $17 trillion for the first time back in May. How much longer the consumer can consume on debt is unclear. Foot Locker, for example, demonstrated how sluggish mall traffic is in many areas with its first-quarter earnings.

Nike may have led the way for footwear stocks, but it was far from the only beneficiary. In fact, Allbirds, which had an even better day at one point in Wednesday’s trading, also offers the best upside potential at 47.52%, thanks to its $2.08 average price target. This is despite it being rated as a Hold. Meanwhile, Skechers, a Moderate Buy by analyst consensus, only offers 5.27% upside potential with an average price target of $56.11 per share.