It’s been a rough ride for Nio (NIO) shareholders in recent years. While share price volatility has certainly benefited some investors, including myself at points, the NIO stock’s long-term trajectory has been downward. However, over the past month, NIO shares have risen more than 70% from a post-pandemic nadir. Despite some optimism, I’m inherently cautious given potential liquidity challenges and the launch of its lower-margin ONVO brand. I’m currently bearish on NIO.

What’s Behind the Rising NIO Share Price?

Nio isn’t yet a household name in many circles, but the Chinese electric vehicle (EV) manufacturer rose to prominence during the pandemic as investors rushed into new energy vehicles (NEVs). For those of you less familiar with the brand, Nio has focused on the production of premium smart EVs. The company has an impressive variety, while employing battery-swapping technology, although I’m bearish on Nio right now.

Nio’s stock recently recovered from a post-pandemic nadir, and this can attributed to a combination of factors that have bolstered investor confidence. First among these is when the company’s strong Q2 earnings report in early September showcased better-than-expected financial results, with the delivery of 57,000 units during the period. These results also preface a possible recovery through 2025 and the potential to lift annual deliveries toward 250,000 units.

This was supported by strong August deliveries, with more than 20,000 units heading out of the factory. Peers in China’s EV market also hinted at improved market conditions. Moreover, Nio Inc. has assured investors that as unit volumes increase, that helps progress toward its long-term vehicle margin target of 25%. More recently, the Chinese government has introduced stimulus measures that should lend a boost, and it also helped drive NIO stock higher.

Can Nio Maintain its Momentum?

NIO stock’s ability to maintain its upward momentum seems doubtful, despite the aforementioned positive developments. The company’s Q2 2024 results included improvements in certain profitability metrics, with decreased operating and net losses compared to previous quarters. These figures suggest that Nio is making progress in cost management while pursuing growth initiatives, such as the “Power Up Counties” program to extend its charging network across China.

However, there are concerns that could bring an end to this momentum. For one, Nio’s large share based compensation program (SBC), while potentially beneficial for retention and productivity, leads to dilution for existing shareholders. This, coupled with a significant increase in SG&A (Selling, General, and Admin) expenses, may hinder the company’s true financial recovery.

Moreover, as the company continues to post losses and burns through cash (even despite the heavy use of SBC), investors will likely become increasingly concerned. Nio currently has a net cash position of ~$433 million, based on cash of $4.99 billion and total debt of $4.56 billion. In Q2 2024, the net loss attributable to shareholders was $705.4 million. Nio’s cash burn during the quarter was around $600 million.

Is Onvo the Answer or the Problem for Nio?

While I’m bearish on NIO stock, it’s worth investigating ONVO, which is Nio’s new sub-brand which presents both opportunities and challenges for the company.

On one hand, ONVO could be the answer to Nio’s quest to increase unit volume and build market share. The L60, ONVO’s first model, is strategically priced to compete with Tesla’s (TSLA) Model Y and aims to attract buyers in the RMB 150,000-225,000 range. Its innovative battery subscription model allows for a lower starting price.

However, ONVO might also introduce new struggles for Nio. First, the lower price point of ONVO vehicles is likely to compress Nio’s overall margins — at least initially. The company only expects ONVO to start contributing positively to its bottom line once it reaches monthly sales targets of 20,000, which may take considerable time and resources to achieve.

Moreover, the introduction of ONVO and the planned launch of another sub-brand, Firefly, will likely increase Nio’s sales and marketing expenses in the coming quarters. Critics will know that this additional spending comes at a time when Nio is already facing financial challenges.

Is Nio Stock a Buy According to Analysts?

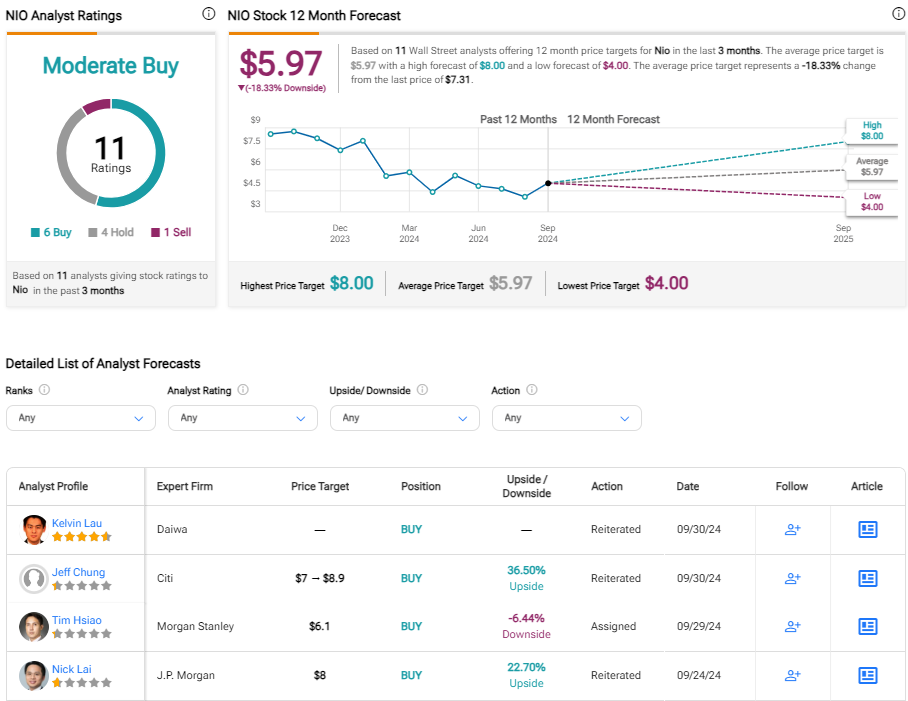

As shown on TipRanks, NIO comes in as a Moderate Buy based on six Buys, four Holds, and one Sell rating assigned by Wall Street analysts in the past three months. However, due to the recent run higher in NIO stock, the average NIO stock price target of $5.97 is nearly 20% lower than the current trading price.

The Bottom Line on Nio Stock

Nio stock is trading considerably above its share price target, and I think that’s an indication that the stock has rallied too high for now. The company has challenges to overcome, including the pursuit of growing the business without putting even more pressure on finances in the near term. Liquidity is an issue for investors to keep an eye on. However, there’s a possible upside scenario. ONVO could provide the volume that Nio needs. There’s a lot to unpack, and I fear the stock will remain sensitive to new Chinese economic data for now. I’m currently bearish due to the recent run-up in the stock price.