Nike (NYSE:NKE) (GB:0QZ6) shares tanked by over 15% in the premarket session today after the athletic apparel giant issued a dismal outlook alongside its fourth-quarter results. While Nike itself is seeing knee-jerk analyst reactions, its outlook is dragging other athletic product stocks lower as well.

Nike’s Dismal Outlook

Nike’s Q4 sales declined by 2% year-over-year to $12.61 billion. While NIKE Direct revenues contracted by 8%, NIKE Brand Digital sales plunged by an even sharper 10% during the quarter. The owner of the Converse and Jordan brands now expects its top line to decline by mid-single digits for the full year.

Analysts Weigh in on Nike

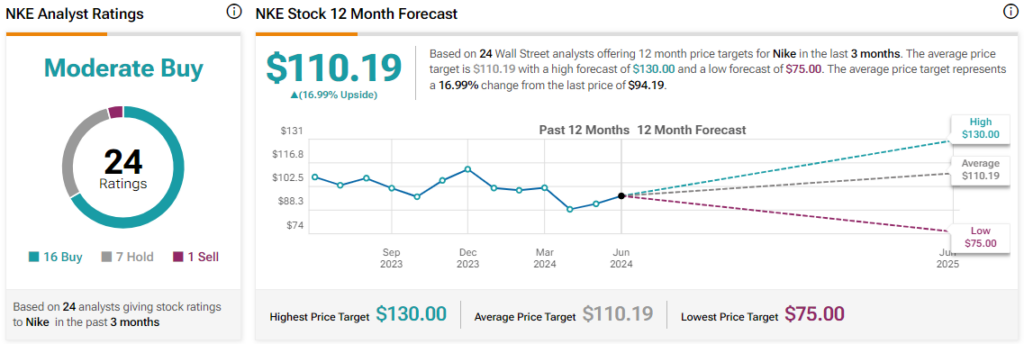

The dismal outlook has prompted sharp analyst reactions for Nike today. Morgan Stanley’s Alexandra Straton has lowered her rating on Nike to a Hold from a Buy while scaling back the stock’s price target to $79 from $114. The analyst cited Nike’s weak near-term prospects for the downgrade. While Wedbush’s Tom Nikic has maintained a Buy call on Nike, the analyst also lowered the price target for the stock to $97 from $115.

Nike’s Downturn Drags Down Athletic Sector

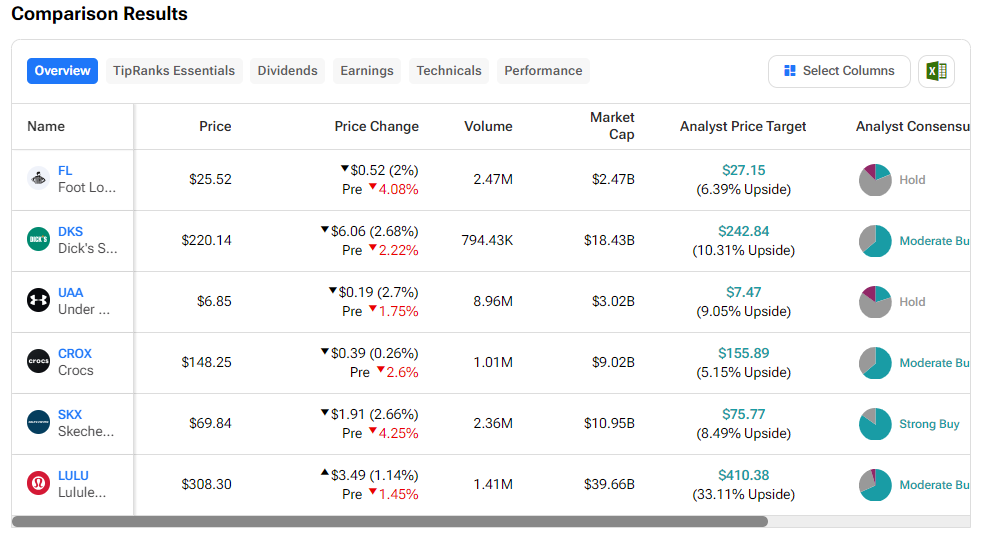

Moreover, Nike’s sales warning is also dragging other athletic product providers sharply lower today. Foot Locker (NYSE:FL) is ticking nearly 4% lower today. Furthermore, shares of DICK’s Sporting Goods (NYSE:DKS), Under Armour (NYSE:UAA), Crocs (NASDAQ:CROX), Skechers (NYSE:SKX), and Lululemon (NASDAQ:LULU) are all witnessing selling pressure.

Is Nike Stock a Buy, Sell, or Hold?

Overall, the Street has a Moderate Buy consensus rating on Nike, alongside an average NKE price target of $110.19. In comparison, the stock is already hovering at $80, its lowest level in the past 12 months.

Read full Disclosure