The coronavirus pandemic has triggered a shift in consumer shopping patterns. Rising unemployment and economic uncertainty have impacted consumers’ discretionary spending with more money being spent on food and essentials. Even giants like Nike are under pressure as COVID-19 fears are impacting store sales.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

However, growing concern about health and fitness and higher digital sales are benefiting Nike, Lululemon, Under Armour and Skechers.

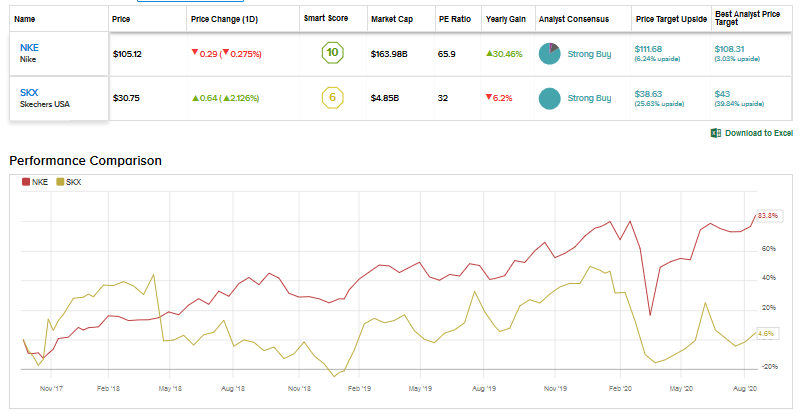

Against this backdrop, we will use TipRanks’ Stock Comparison tool, to analyze Nike and Skechers alongside each other to see which stock offers the most compelling investment opportunity.

Nike (NKE)

Nike is one of the most popular athletic apparel and footwear global brands. Aside from the US, the company has a strong presence in international markets, which helped it generate 61% of the overall revenue in fiscal 2020 (ended in May). The company’s fiscal 2020 revenue declined 4.4% to $37.4 billion, reflecting the impact of COVID-19 on the fiscal fourth-quarter results.

Prior to COVID-19, the company’s revenue grew by about 9% in the first half of fiscal 2020. However, the temporary closure of physical stores to control the corona outbreak caused a 38% year-over-year drop in Nike’s fiscal fourth-quarter revenue to $6.31 billion. Lower revenue and gross margin contraction saw the company post a loss per share of $0.51 in the fourth quarter of fiscal 2020 compared to EPS of $0.62 in the fourth quarter of fiscal 2019.

In its fourth-quarter press release in June, the company disclosed that about 90% of its owned stores reopened across the globe. Much to the relief of investors, Nike stated that retail traffic was improving on a week-over-week basis at the reopened stores with higher conversion rates. Nike expects sequential quarterly improvement in its fiscal 2021 business as the retail market reopens. The company predicts its fiscal 2021 revenue to be flat to up compared to the prior year.

The direct-to-consumer channel was already a priority for Nike. However, the company is now accelerating its e-commerce growth as more consumers are shopping online for sneakers and athletic gear instead of visiting the stores amid the pandemic. Nike’s digital sales rose 75% in the fiscal fourth quarter and contributed 30% of the overall revenue.

Most notably, Nike’s annual digital sales crossed $1 billion in both Greater China and Europe, Middle East and Asia regions for the first time in fiscal 2020. Previously, the company aimed for 30% of digital penetration by fiscal 2023. But now it is looking for 50% digital penetration. Its recently announced Consumer Direct Acceleration strategy aims to boost the company’s digital sales through greater focus and continued investments. And last month the company also announced leadership changes and streamlining efforts to align with its new strategy.

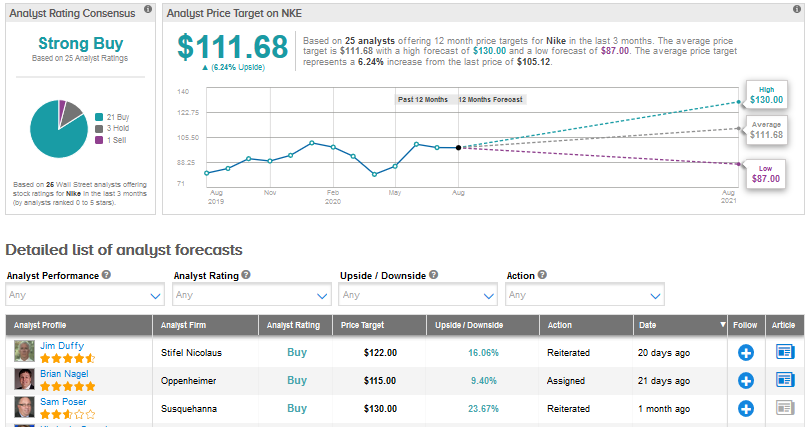

In July, Oppenheimer analyst Brian Nagel reaffirmed his Outperform rating for Nike with $115 price target and stated that, “Digital technologies and ecommerce efforts are allowing NKE the opportunity to connect more effectively with consumers and to improve underlying operating processes.”

He added: “We very much view the newly introduced CDA [Consumer Direct Acceleration] strategic effort as the next step in management’s further digitalizing the company’s already dominant and powerful global business model.” (See Nike stock analysis on TipRanks)

The Street also mirrors five-star analyst Nagel’s bullish stance. Twenty-one Buys, 3 Holds and 1 Sell add up to a Strong Buy consensus analyst rating for Nike stock. The average price target of $111.68 suggests a possible upside of 6.24% over the next 12-months.

Skechers (SKX)

Skechers might look like a dwarf compared to Nike. However, it has rapidly emerged as the fastest-growing shoe company in the US. It has also been aggressively expanding beyond the domestic market. The company’s international wholesale and retail businesses accounted for about 58% of its 2019 sales.

Skechers delivered better-than-feared second-quarter results. The company’s June quarter sales declined 42% year-over-year to $729.5 million, reflecting the dreadful impact of the pandemic. However, the second-quarter sales were better than analysts’ expectation of $660 million.

The company’s international sales fell 37.8% while domestic business was down 47.3% in the second quarter. However, an 11.5% growth in China sales and a stellar 428.2% growth in e-commerce sales saved the company to a certain extent. The company slipped into a loss per share of $0.44 in the second quarter compared to EPS of $0.49 in the second quarter of last year. It managed to fare better than analysts’ loss per share estimate of $0.66. The company’s efforts to cut down non-essential discretionary spending helped in delivering a better-than-anticipated bottom line.

In its second-quarter press-release, Skechers disclosed that over 90% of its stores have reopened and that the company is seeing recovery in some markets. In its earnings call, the company revealed that its brand was resonating with a wider and younger audience in its e-commerce channels in North America, Chile and Europe.

Based on feedback from its global partners, Skechers believes that it remains a go-to footwear brand for consumers looking for casual, comfort and value products amid this crisis. To capture e-commerce growth, the company launched its new shopping platform in the US in July.

It plans to roll out this platform to additional countries later this year as well as in the coming years. Also, aggressive digital advertising, a new mobile app, and a new loyalty program are expected to strengthen the company’s digital capabilities.

Susquehanna analyst Sam Poser reiterated his Buy rating and raised his price target to $41 from $39 following Skechers’ second-quarter results. In a research note, he noted, “2Q20 results show momentum is building as headwinds from the crisis begin to subside; SKX’s value proposition is unmatched in the footwear space and demand for the product is robust.”

The analyst continued: “A best-in-class supply chain provides further opportunities to gain market share, in our view. SG&A came in well below expectations, demonstrating spending discipline. Many uncertainties remain in play as 2H20 unfolds, but we believe SKX is set up exceptionally well heading into FY21.” (See Skechers stock analysis on TipRanks)

And it also looks like Wall Street is optimistic about Skechers stock as reflected in its Strong Buy consensus rating with 8 Buys and no Hold or Sell ratings. An average price target of $38.63 implies an upside potential of 25.63% in the stock over the next 12-months.

So which stock looks better?

Nike’s consistent dividends, strong brand name, innovation and accelerated focus on digital growth back it’s Strong Buy rating. However, significant upside potential over the next year and the complete bullish Street consensus rating for Skechers makes it a better pick currently.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment