Athletic footwear, clothing, and accessory retailer Nike (NYSE:NKE) is trying to win back the support of some of the partner retailers that it had earlier severed ties with to get the excess inventory off its shelves. To name a few, Designer Brands (NYSE:DBI) and Macy’s (NYSE:M) are among those who have reunited with their favorite retailer and are excited to relaunch Nike’s products with larger assortments.

The Change Between Then and Now

Owing to the macroeconomic headwinds posed by the pandemic, Nike decided to focus more on its own distribution channel to strengthen its direct sales. This involved reducing bulk order shipments to partner retailers. Moreover, Nike’s management was disappointed with the poor shelf displays and related customer experiences at some of the retail partners. Thus, the American brand decided to take things into its own hands by investing in physical stores and online shopping apps to enhance the overall shopping experience. Plus, the company asked retail partners to implement the One Nike Marketplace strategy, aiming to standardize the customer experience across all channels.

However, with the easing of supply chain bottlenecks post-pandemic, and the opening of economies worldwide, Nike experienced improvements in its supply chain. As a result, the company now has most of its products available on time and in excess of demand. This has prompted Nike to once again turn back to retail partners and increase the levels of inventory sent to clear their shelves. Like other retailers, Nike is even offering higher discounts on products to boost sales, which is impacting its margins. Despite that, Nike is pushing for stronger partnerships to churn out more products. Last month, Nike even announced the restructuring of top-ranking officials to supercharge its focus on product innovation, brand storytelling, and the marketplace.

Is Nike Stock a Buy, Hold, or Sell?

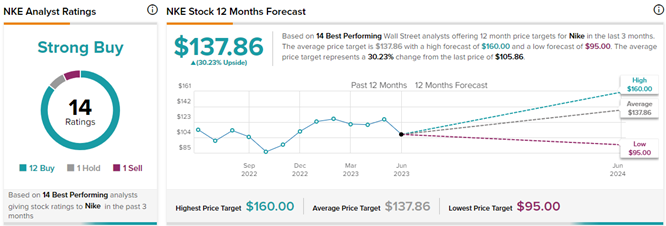

On June 9, Guggenheim analyst Robert Drbul cut the price target on NKE stock to $135 (27.5% upside potential) from $145 while maintaining a Buy rating. While Drbul remains optimistic about Nike’s brand portfolio, competitive position, and financial strength, he believes that certain headwinds could impact the company’s performance. These include difficult wholesale comparisons, the expectation of the Chinese market, a gradual recovery in gross margins pressured by discounts and promotions, as well as foreign exchange pressures.

On TipRanks, out of the top 14 analysts who recently rated NKE stock, 12 assigned a Buy rating, one rated it a Hold, and one gave it a Sell rating. Meanwhile, the overall average Nike price target of $138.42 implies 30.8% upside potential from current levels. Year-to-date, NKE stock has lost 10.3%.