Athletic footwear and apparel major NIKE, Inc. (NYSE: NKE) has reported better-than-expected results for the third quarter ended February 28, 2022.

Following the results, shares of the company rose 5.3% to close at $137.10 in Monday’s extended trading session.

Revenue & Earnings

NIKE’s quarterly revenues grew 5% year-over-year to $10.9 billion and surpassed the consensus estimate of $10.59 billion. NIKE brand revenues, which grew 8% year-over-year to $10.3 billion, accounted for almost 94.5% of the total quarterly revenues of the company.

Meanwhile, the company’s earnings declined 3.3% from the previous year to $0.87 per share but surpassed the consensus estimate of $0.71 per share.

NIKE’s gross margin improved by 100 basis points from the prior year to 46.6%. Its cash balance also witnessed an increase of $939 million from the year-ago period to $13.5 billion.

Dividend & Share Buybacks

While the company paid dividends of $484 million in the quarter, up 12% year-over-year, its share repurchases stood at $1.2 billion.

Management Commentary

The CEO of NIKE, John Donahoe, said, “NIKE’s strong results this quarter show that our Consumer Direct Acceleration strategy is working, as we invest to achieve our growth opportunities. Fueled by deep consumer connections, compelling product innovation and an expanding digital advantage, we have the right playbook to navigate volatility and create value through our relentless drive to serve the future of sport.”

Stock Rating

Consensus among analysts is a Strong Buy based on 17 Buys and five Holds. The average NIKE price target of $164.81 implies upside potential of 26.6% from current levels. Shares have declined 5.8% over the past year.

Website Traffic

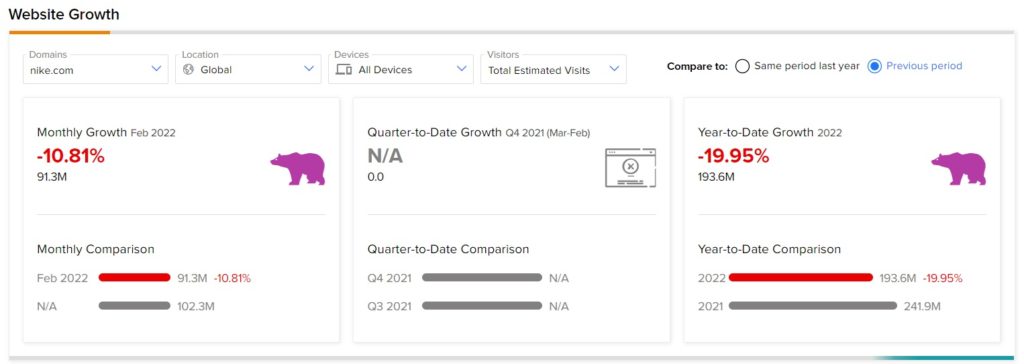

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into NIKE’s performance this quarter.

According to the tool, the NIKE website recorded a 10.81% monthly decline in global visits in February, compared to the same period last year. Further, the website traffic has declined 19.95% year-to-date, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

On Holding Delivers Robust Q4 Sales & Outlook; Shares Gain 14%

Brookfield Expands Footprint in Australia With $1.1B La Trobe Acquisition

Anaplan Signs $10.7B Takeover Deal