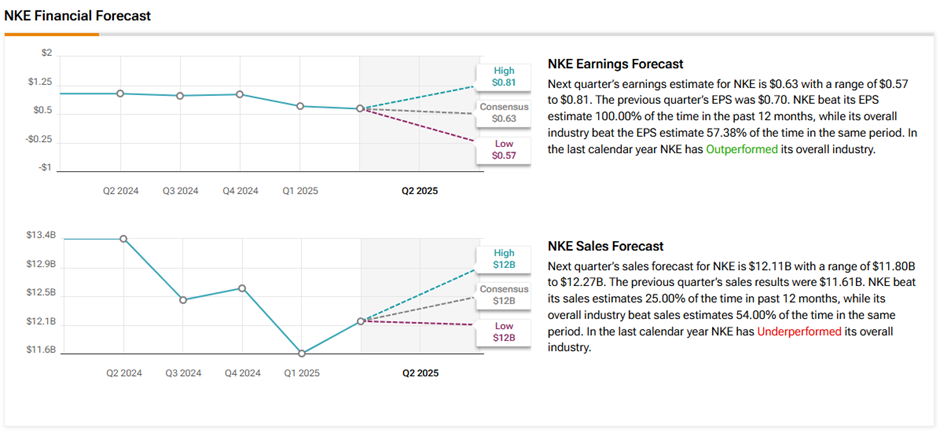

Athletic footwear maker Nike (NKE) is set to release its second quarter Fiscal 2025 results on December 19, after the market closes. The Street expects Nike to post earnings per share (EPS) of $0.63, significantly lower than the prior year’s figure of $1.03. Similarly, analysts expect Nike to report a 9.6% year-over-year decline in revenues, with a consensus of $12.11 billion, according to TipRanks’ data.

Nike’s Continues to Face Challenges

Even though Nike has exceeded earnings estimates in seven of the past eight consecutive quarters, its sales and profits have been under constant pressure. Intense competition from both domestic and foreign brands, especially in one of its core markets, China, has impacted Nike’s performance this year.

Having said that, analysts and investors alike are excited about the return of Nike veteran Elliot Hill as the CEO of the company. Nike withdrew its full-year guidance during the Q1 results, citing the need for more time to evaluate performance under new leadership. NKE stock has lost 26.9% so far, compared to a 27.3% gain in the S&P 500 (SPX) index.

Analysts’ Views Ahead of Nike’s Q2 Results

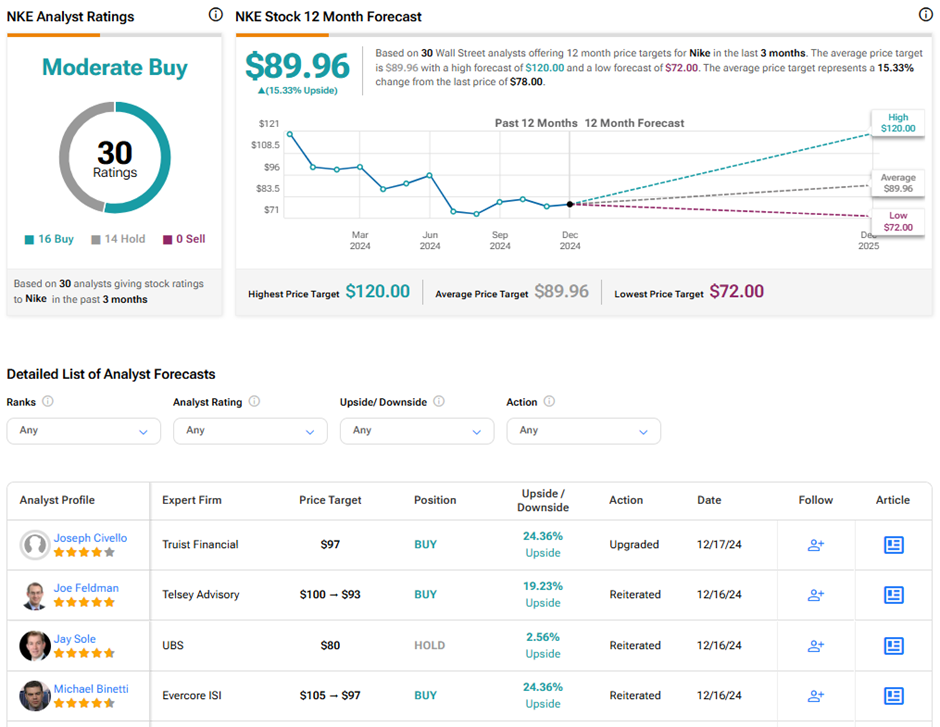

In the past week, 15 analysts have reviewed their ratings on Nike stock in anticipation of the results. Of these, ten analysts have given Nike stock a Buy, while five have given a Hold rating on the stock.

Yesterday, Truist Financial analyst Joseph Civello maintained a Buy on Nike stock and a price target of $97 (24.4% upside). Civello believes that the stock has already underperformed the broader market owing to the challenges, and it could see an uptick after the Q2 results. With CEO Hill in place now, Civello believes that even the slightest optimism that the company could turn around in Fiscal 2026 could push Nike stock higher. The analyst thinks that Nike stock could start outperforming well before seeing any tangible fundamental improvements.

Meanwhile, Telsey Advisory analyst Joe Feldman cut the price target on NKE stock to $93 (19.2% upside) from $100 while keeping a Buy rating. Despite the short-term challenges, Feldman remains optimistic about Nike’s long-term potential. The analyst expects Nike to provide positive updates on its product innovation, distribution strategy changes, and inventory clearance plans.

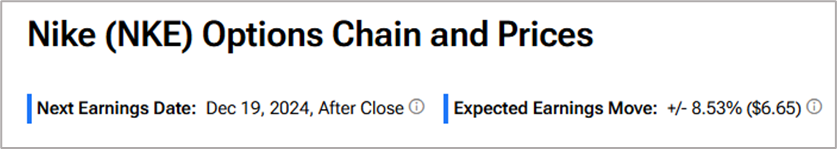

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a large 8.53% move in either direction for Nike stock.

Is Nike Stock a Buy or Sell?

Analysts remain divided on Nike’s stock trajectory owing to the current challenges. On TipRanks, NKE stock has a Moderate Buy consensus rating based on 16 Buys versus 14 Hold ratings. Also, the average Nike price target of $89.96 implies 15.3% upside potential from current levels.