Cigna on Dec. 31 announced the completion of the sale of its Group Life and Disability Insurance Business to mutual life insurer New York Life for $6.3 billion. Shares of the mutual life insurance company rose 2% at the close on Thursday.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Previously on Dec.18, 2019, Cigna (CI) disclosed the acquisition could potentially add 3,000 employees, over nine million customers, and boost New York Life’s portfolio of strategic businesses, supporting the core retail life insurance franchise and bolstering the company’s financial strength. It was also stated that the new business would be rebranded as New York Life Group Benefit Solutions.

Cigna will use the sale proceeds towards share repurchase and repayment of debt in 2020. The board increased the company’s share repurchase authority by $3 billion to $4 billion. The company expects the transaction to be neutral to EPS in 2020 and modestly accretive to EPS in 2021.

New York Life and Cigna have also inked a multi-year partnership to provide distinguished, cohesive health and group benefit solutions for clients and prospects.

New York Life Group Benefit Solutions will operate within New York Life’s portfolio of strategic businesses, including Group Membership Association, Institutional Annuities, Institutional Life, New York Life Direct, and Seguros Monterrey New York Life, among others.

“We are excited to welcome to New York Life our new employees and the millions of new customer relationships that we will gain through this milestone transaction. We look forward to building on our leading group benefit solutions market position in the years ahead,” said New York Life CEO Ted Mathas.

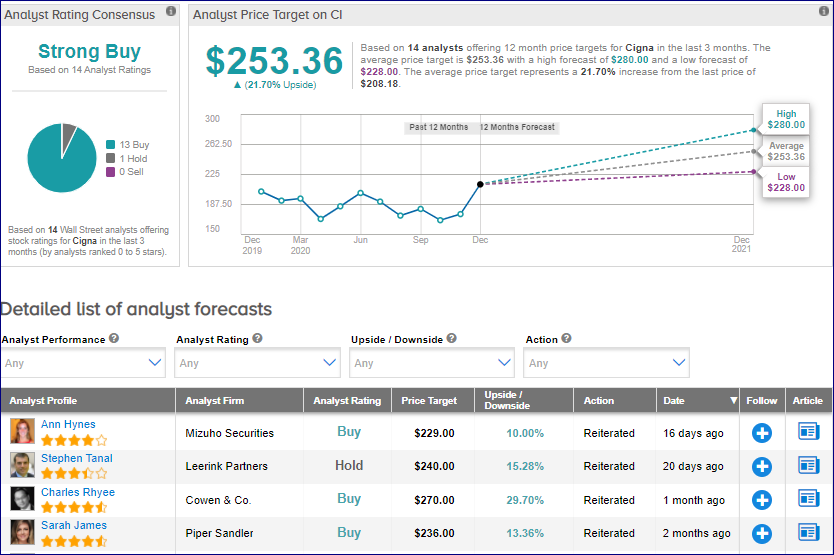

Mizuho analyst Ann Hynes raised the price target on the stock to $229 (a 10% upside potential) from $220 on Dec. 18 and reiterated a Buy rating. Hynes believes clinical labs, contract research organizations and acute care have the greatest earnings visibility going into 2021.

From the rest of the Street, the stock scores an analyst consensus of a Strong Buy based on 13 Buys and 1 Hold. The average analyst price target of $253.36 implies upside potential of 21.7% to current levels. (See CI stock analysis on TipRanks)

Related News:

Microsoft Says SolarWinds Hackers Accessed Its Source Code; Street Stays Bullish

Enphase To Replace Tiffany On S&P 500; Street Sees 24% Downside

Intrepid Pops 36% On Higher Potash Prices; Street Sees 55% Downside