New Residential Investment Corp. (NRZ) approved a 33.3% hike in its quarterly dividend to $0.20 per share from $0.15. The provider of capital and services to the mortgage industry increased its dividend for the third consecutive quarter. Shares of New Residential advanced 4.1% in Thursday’s pre-market session.

New Residential said that the new quarterly dividend will be paid on Jan. 29, 2021, to shareholders of record as of Dec. 31, 2020. Its annual dividend of $0.80 per share now reflects a dividend yield of 8.3%.

The company’s CEO Michael Nierenberg said, “Today’s dividend increase reflects our confidence in the earnings power and strong financial position of our Company as we continue to focus on unlocking value for all stakeholders.” (See NRZ stock analysis on TipRanks)

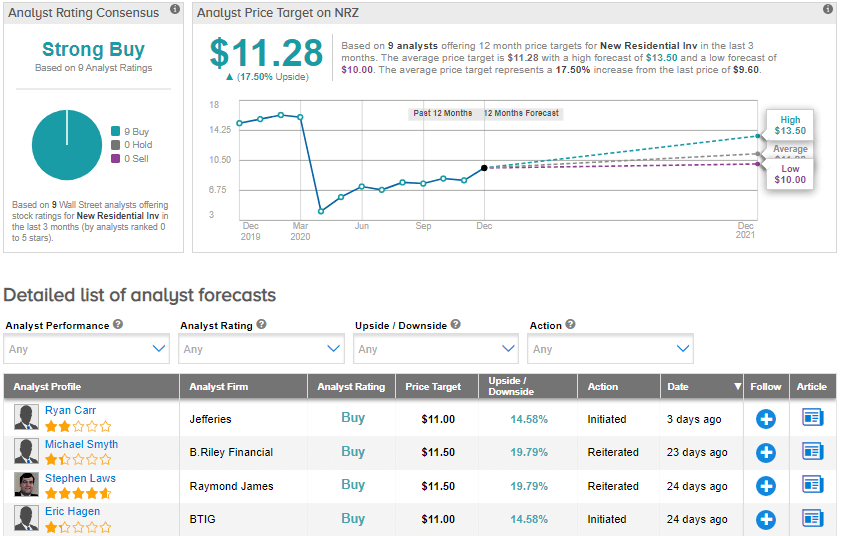

On Nov. 24, Raymond James analyst Stephen Laws raised the stock’s price target to $11.50 (19.8% upside potential) from $10.50 and maintained a Buy rating. He said, “We expect strong origination volumes and attractive gain on sale margins to drive strong near-term results, and we continue to expect a dividend increase in 4Q.”

Meanwhile, the rest of the Street firmly shares Laws’ bullish outlook on the stock. The Strong Buy analyst consensus is based on 9 unanimous Buys. The average price target stands at $11.28 and implies upside potential of about 17.5% to current levels. Shares have declined by 40.4% year-to-date.

Related News:

Franklin Resources Hikes Dividend By 4%; Street Sees 12% Downside

Waste Management Announces 5.5% Dividend Hike, New Share Repurchase PlanAdvanced Energy Introduces Quarterly Dividend Plan; Shares Rise