New Oriental Education (EDU), the largest provider of private educational services in China, has reported a solid earnings beat for the first fiscal quarter ended August 31, 2020. Shares are now rising 2.4% in Tuesday’s trading.

Specifically, EDU reported FQ1 Non-GAAP EPS of $1.15, which beat Street consensus by $0.10. Similarly, GAAP EPS of $1.09 easily topped analyst estimates by $0.17.

Meanwhile revenue of $986.37M dropped 7.8% year-over-year, but nonetheless beat analyst estimates by $31.73M. Operating income decreased by 38.9% year-over-year to $150.3M.

Operating costs and expenses for the quarter were $836.1M, representing a 1.3% increase year-over-year, with operating margin at 15.2% vs 23% in the same period of the prior fiscal year.

Encouragingly, EDU also reported that total student enrollments in academic subjects tutoring and test preparation courses increased by 13.5% year-over-year to approx. 2,961,100.

The total number of schools and learning centers was 1,472 as of August 31, 2020, an increase of 211 compared to 1,261 as of August 31, 2019.

Michael Yu, New Oriental’s Executive Chairman, commented, “COVID-19 outbreak continues to raise hurdles for businesses across the globe… However, we are pleased to report a set of encouraging results. Net revenue for the first quarter was down 8.0% year over year, which is better than what we guided in the previous quarter.”

He noted that the decrease was mainly due to the delayed enrollment for summer and autumn classes and the shortening of summer holiday in many major cities by one to two weeks this year, as well as the delayed resumption of offline operation in certain cities, such as Beijing.

While the company’s after-school tutoring businesses have recorded solid growth, its overseas related businesses face difficult challenges due to the cancellation of overseas exams and restrictions on travels. For instance, the overseas test preparation business and the overseas consulting and study tour business declined by approximately 51% and 31% respectively.

Mr. Yu continued, “Looking ahead, we believe that our financial performance will bottom out starting from the second fiscal quarter.”

Indeed, New Oriental expects total net revenues in the second quarter of fiscal year 2021 to be in the range of $863.7M to $887.3M, representing year-over-year growth of 10% to 13%.

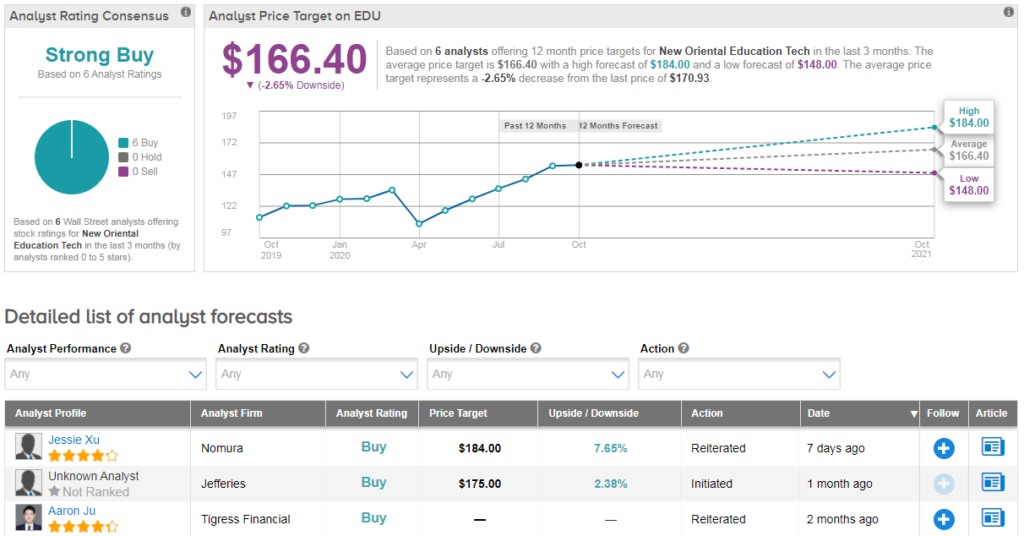

Shares in EDU have climbed over 40% year-to-date and the stock scores a bullish Strong Buy Street consensus. However thanks to the recent rally the average analyst price target indicates that shares could pull back from current levels.

One analyst saying ‘buy’ is Tigress Financial’s Aaron Ju. The analyst notes that EDU’s AST (after-school tutoring) offline long-term business trends remain stable with an upward trajectory.

“EDU’s implementation of its Online-Merge-Offline models and strong summer promotion will further drive market consolidation and student enrollments” he comments, adding “We expect to see EDU’s offline revenue and student enrollment recover after 1QFY21 and believe EDU stock price still has significant upside and recommend purchase at current levels.” (See EDU stock analysis on TipRanks)

Related News:

Twilio Stock Gains 7.7% On $3.2B Segment Deal; Street Stays Bullish

Bandwidth Snaps Up Voxbone In $527M Cloud Communications Deal; Shares Rise 4%

Wix Teams Up With Vodafone For UK Expansion; Shares Now Up 138% YTD