New Mountain Finance on Jan. 4 announced that the business development company’s board has authorized an extension of a program for repurchasing up to $50 million worth of its common stock.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company said that the extension of the repurchase program was undertaken to prevent the undervaluation of the company’s share price due to continued market volatility and uncertainty.

The repurchase program will be executed by Dec. 31, 2021 or earlier. The timing and number of shares to be repurchased will depend on market conditions and alternative investment opportunities. To date, New Mountain Finance (NMFC) has made repurchases worth $2.9 million under the program.

Additionally, subsequent repurchases would also be conducted under the Investment Company Act of 1940, as amended. However, there were no assurances regarding the company’s engagement in additional repurchases.

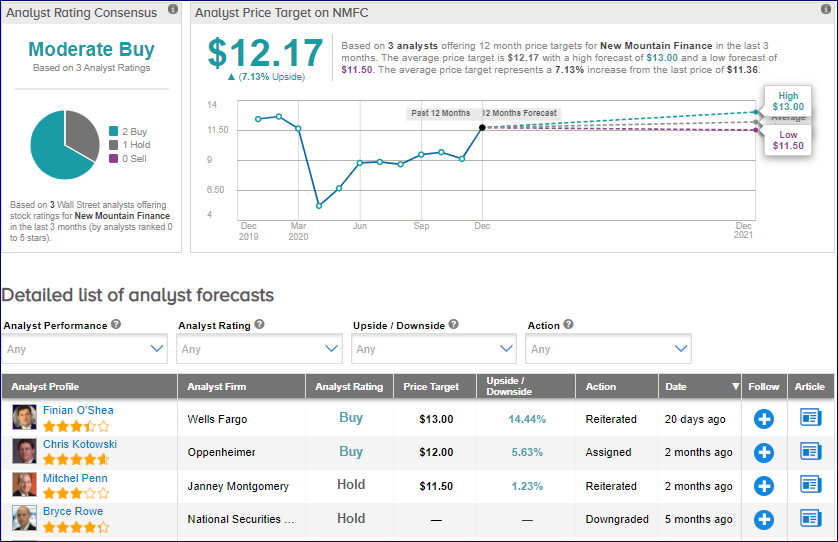

In reaction to the company’s Q320 results, Oppenheimer analyst Chris Kotowski on Nov. 5 raised the stock’s price target to $12 (5.6% upside potential) from $11 and reiterated a Buy rating.

“NMFC reported 3Q20 adjusted net investment income (NII) of $0.30/share, in line with both our and consensus’ estimate of $0.30 and matching the $0.30 dividend,” said Kotowski.

“On balance, the key takeaways from the report are that the company’s deleveraging program has been completed and that it is still roughly able to cover the dividend on a core basis. At the same time, asset quality—which should be everyone’s primary concern—was very stable and the company has ample liquidity to grow,” the analyst noted. (See NMFC stock analysis on TipRanks)

From the rest of the Street, the stock scores a cautiously optimistic analyst consensus of a Moderate Buy based on 2 Buys and 1 Hold. The average analyst price target of $12.17 implies upside potential of 7.1% to current levels.

Related News:

McEwen Mining Closes C$12.5M Flow-Through Financing

Fiat-Peugeot Merger Could Lead To Job Losses – Report

Monmouth Gets Board Nominations From Blackwells; Street Is Cautiously Optimistic