Two bits of good news in as many days for chip stock Intel (INTC). It turns out that this one is pretty impressive, too, as Intel made a deal to supply Amazon (AMZN) with chips for its cloud computing operations. The move was good enough for Intel investors, who sent shares up over 3% in Tuesday afternoon’s trading.

Intel has been working to bring its foundry operations up to full steam for some time now, and not without some success. The success has not been quite as pronounced as some might like, however, and that has left investors disappointed.

Still, Intel will be building custom AI chips for Amazon’s Amazon Web Services (AWS) platform as part of an already-established deal between the two that has stood for years. While the exact value of the contract was not revealed, Reuters reports that the value is in the “multibillion” dollar range, a move that should prove entirely welcome at Intel.

Speaking of the Chip Foundry…

Another new report emerged that details what Intel is planning to do with its chip arm. While many have thought that the foundry was a drag on Intel overall, it may not be much longer. Reports noted that the foundry is likely to be a drag on its own operations fairly soon, as it will be split into an independent subsidiary.

Further, the subsidiary will have an independent board of directors. This is one of the things decided at Intel’s recent three-day board summit, which was said to have made several decisions in the meantime. It is good that at least one of these decisions emerged, and hopefully, more will in the coming days.

Is Intel a Buy, Hold, or Sell?

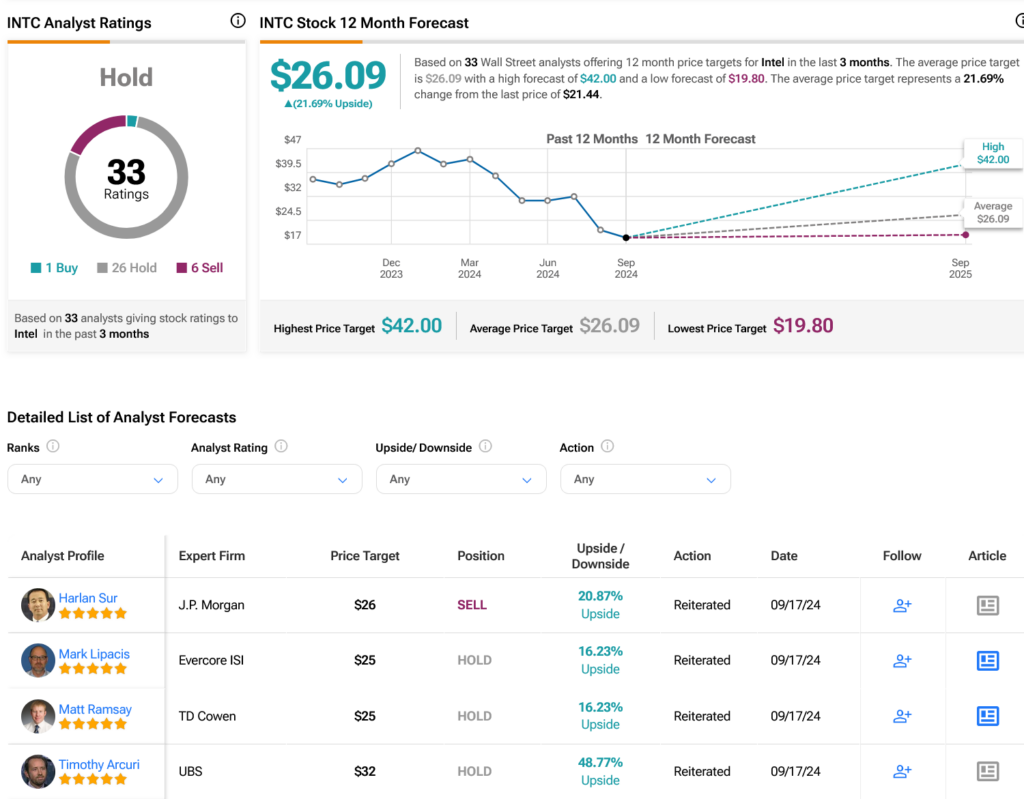

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 26 Holds, and six Sells assigned in the past three months, as indicated by the graphic below. After a 42.43% loss in its share price over the past year, the average INTC price target of $26.09 per share implies 21.69% upside potential.