Legacy automaker Ford Motor Co. (F) has some exciting new plans, but the only thing that seems to excite shareholders right now is abandoning ship. Despite new initiatives to increase its electric vehicle (EV) sales and make more exciting new cars, Ford shares slid 2% in Monday afternoon trading.

The program to jumpstart EV sales will kick off October 1, according to reports from CNBC, and aim to put customers’ concerns about buying an EV to rest. Those who buy or lease a new Ford EV will be treated to free home-charging installation systems—no more concern about not being able to find a charger near you—and some new information to alleviate consumers’ “range anxiety,” that their car will suddenly run out of power on the road.

The program is known as the “Ford Power Promise,” and it looks to make Ford electric vehicles more palatable to a public concerned about moving away from gas engines. Ford is even throwing in free roadside assistance for 60,000 miles or five years, whichever comes first.

No More Boring Cars!

A Dilbert comic strip once described the car industry as a bunch of designers trying to make attractive cars that will never exist, then proving their management skills by making ugly cars. Ford wants to streamline that process a bit and stop making boring cars, which is not that far from not making ugly cars.

Ford is set to focus on the “iconic vehicle business” now. More specifically, Ford dropped the Mondeo—which was known as the Fusion until 2018—the Focus and the Fiesta. Meanwhile, greater focus will be put on electric versions of the Mustang muscle car and Bronco sport utility vehicle (SUV).

Is Ford a Good Stock to Buy Right Now?

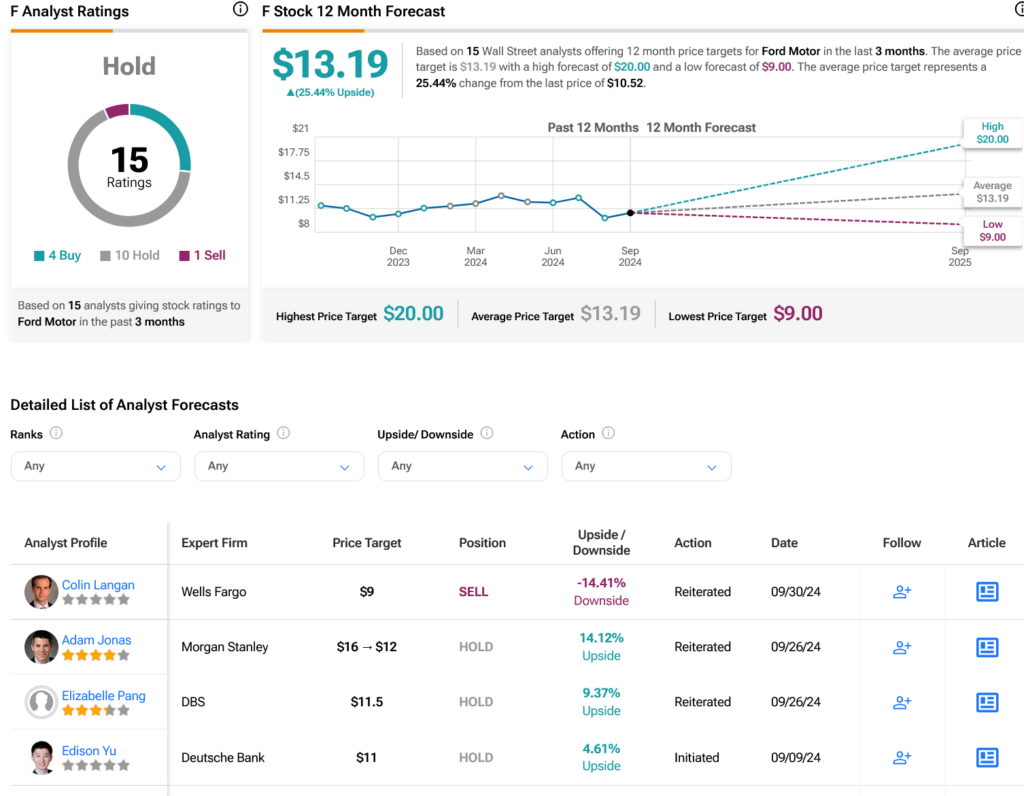

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on four Buy, 10 Hold, and one Sell ratings assigned in the past three months, as indicated by the graphic below. After a 8.41% loss in its share price over the past year, the average F price target of $13.19 per share implies 25.44% upside potential.