Earlier today, new word came out from aerospace company Boeing (BA) about a possible return date for the totally-not-stranded-in-space astronaut duo. In addition, there was news about a helicopter delivery and the January 5 door plug incident that saw a piece of a 737 MAX 9 aircraft fall off during a flight. Little of it helped Boeing shares, though, as they slid nearly 2% in Monday afternoon’s trading.

Boeing continues to face a potential parking crisis at the International Space Station. Reports suggest that the firm has until around mid-August to get its people home, as they’ll be needing the docking space for another upcoming mission.

Further, reports note that we’ll be getting a much more detailed look at the January 5 incident that, in many ways, started Boeing’s downhill slide. Starting tomorrow morning, Boeing will face 20 hours of hearings from the National Transportation Safety Board (NTSB), which will release more than 60 documents gathered since the incident to the public.

Meanwhile, the Good News

The good news for Boeing, such as it was, was that it delivered the first MH-139A Grey Wolf helicopter as part of a contract with the U.S. Air Force. Interestingly, this helicopter was actually produced under the terms of a “low-rate production contract,” which is a new model of agreement that covers an initial production phase. It’s reportedly based on the AW139 helicopter and is geared toward security operations at nuclear missile sites.

The aircraft arrived at Montana’s Malmstrom Air Force Base, and with one of the new units in hand, the Air Force now has the option to “…make a full-rate production decision in the future,” according to Boeing.

Is Boeing Stock a Buy, Sell, or Hold?

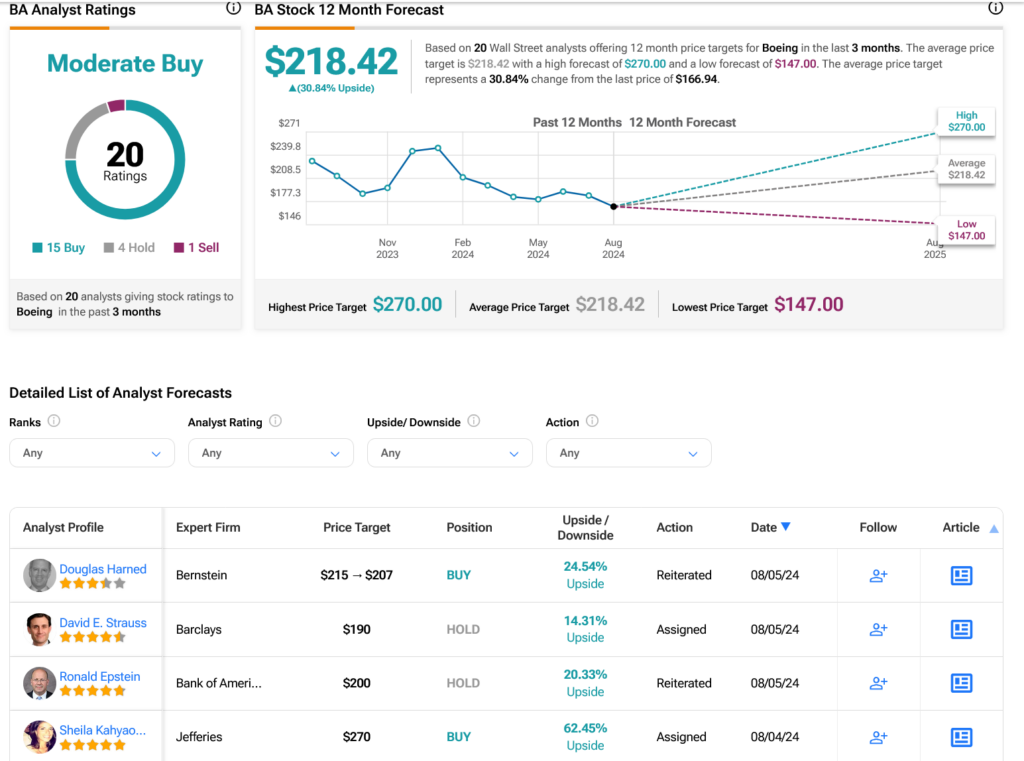

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys, four Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 30.24% loss in its share price over the past year, the average BA price target of $218.428 per share implies 30.84% upside potential.