With prices on everything going up, why should our Netflix (NFLX) service be much different? Recent reports suggest that Netflix is abandoning a key plan, forcing customers to choose from different—and not necessarily better—alternatives. Investors aren’t exactly happy either, and the video steamer’s shares are down nearly 2% in the closing minutes of Friday’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The new reports suggest the $11.99 a month plan, the basic ad-free plan, is on its way out. It isn’t even an option for new subscribers and hasn’t been since July 2023. But those who had already subscribed were allowed to remain at that tier. Now, that’s no longer going to be an option.

The remaining plans include a $6.99-a-month plan, though you’ll have to suffer through advertising to get in on that one, and a $15.49 plan that offers ad-free service but only standard-definition video. The $22.99 plan, meanwhile, includes Ultra HD and offers no advertising with it. Interestingly, the “standard with ads” tier brought in a hefty surge in subscriptions back in November 2022 when it originally got started.

Chasing India

Netflix is looking to add more customers overall, and it’s looking to an unconventional source to do so: India. While many competitors are reportedly turning away from the world’s third-largest economy—and some believe it will reach the second-largest by 2031, under certain conditions—Netflix is pivoting into India.

It actually represented the second-highest source of net subscriber additions in the second quarter and the third-largest source of revenue growth. Netflix points to a “localized strategy and product mix” for supporting such results. Having already seen a note of success therein, it’s little surprise, therefore, that it’s looking to keep the streak alive and draw more value out of the country.

Is Netflix a Hold or Sell?

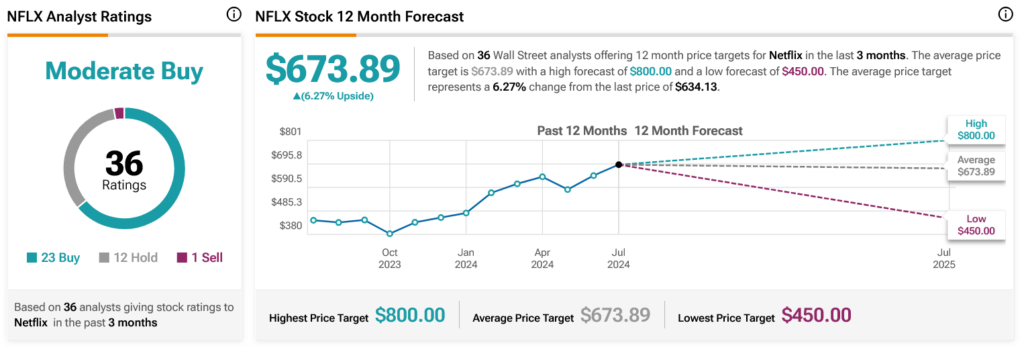

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 23 Buys, 12 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 44.89% rally in its share price over the past year, the average NFLX price target of $673.89 per share implies 6.27% upside potential.