Streaming giant Netflix (NFLX) is set to release its third quarter 2024 financials on October 17. Wall Street analysts are forecasting growth in both revenue and earnings, suggesting strong near-term performance for the company. The analysts expect the company to report earnings per share of $5.10, a 37% year-over-year increase. Revenue is also expected to climb 14.4% from the same period last year, reaching $9.62 billion, according to data from TipRanks.

It’s worth highlighting that Netflix has consistently delivered strong results each quarter. In the most recent Q2, the company added an impressive 8.05 million new subscribers, surpassing analyst expectations and reinforcing its dominance in streaming.

Interestingly, Netflix has had a strong 2024 so far, with shares rising 46% year-to-date. The company’s growth has been fueled by an expanding content library, a shift to advertising, global expansion, successful password-sharing initiatives, and efforts to boost subscriber growth. Despite some ongoing volatility, Netflix appears to be well-positioned for another strong showing in Q3.

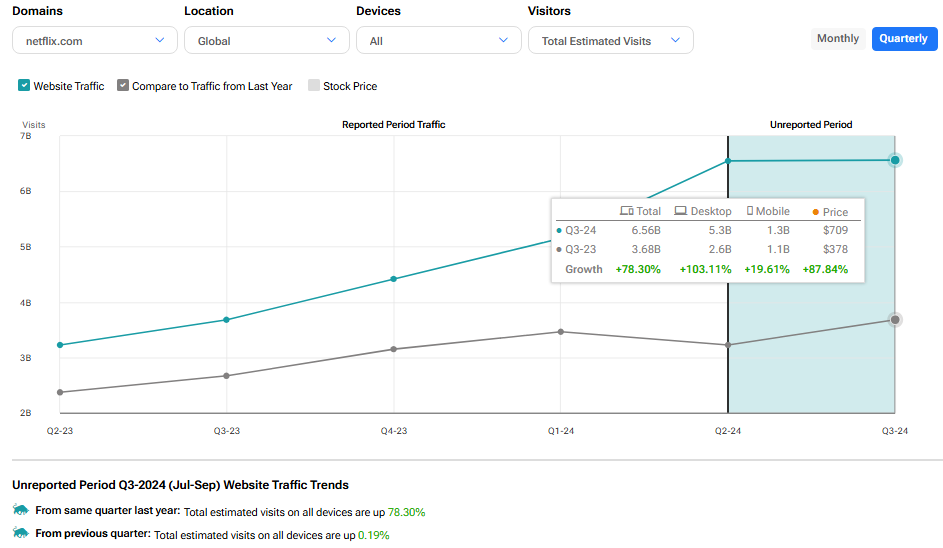

Encouraging Website Traffic Trend

In addition to optimistic analyst estimates, Netflix’s website traffic data also points to strong results for the upcoming Q3 quarter. It should be noted that investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame.

For NFLX, TipRanks’ website traffic screener reveals that the traffic increased sequentially as well as year-over-year in Q3. According to the tool, the number of visits to netflix.com increased 78.3% from the year-ago quarter and 0.19% sequentially. This rise in visits indicates a growing subscriber base, supported by Netflix’s strong content portfolio.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can gauge options traders’ expectations for the stock post-earnings report. Based on a $700 strike price, with call options priced at $34.38 and put options at $20.63, the expected price movement, based on the at-the-money straddle is 7.75%.

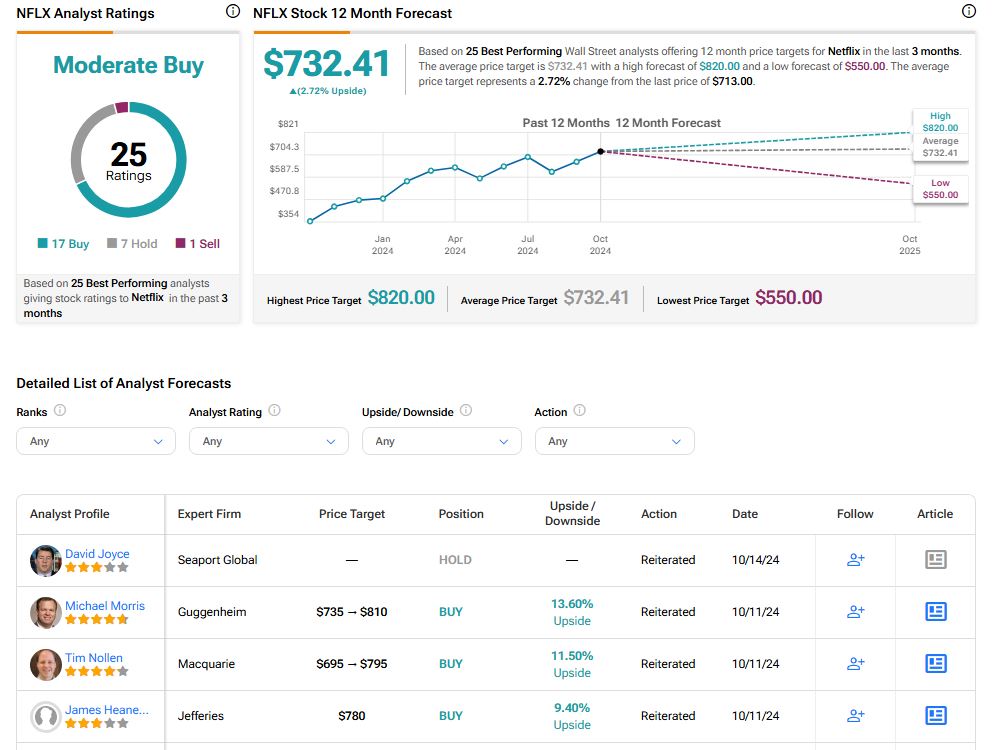

Is Netflix Stock a Buy Right Now?

Turning to Wall Street, NFLX stock has a Moderate Buy consensus rating. Out of the 25 analysts covering the stock, 17 have a Buy recommendation, seven have a Hold, and one recommends selling the stock. Furthermore, at $732.41, the average Netflix price target implies 2.72% upside potential.