The golden days for American video streaming platform Netflix, Inc. (NASDAQ: NFLX) seem to be fading away. The pandemic-driven restrictions forced people to stay glued to their TV sets streaming movies and shows online.

However, as the spread of the virus is slowing down, so does the revenue growth of the subscription service provider. Add to that a host of both local and international competitors vying to grab the consumers’ attention, coupled with rising costs.

Investors’ worst fears came true when Netflix reported its fourth-quarter results, which failed to meet both revenue and subscriber expectations. Shares plunged more than 20% during the extended trading session on January 20.

Despite showcasing an interesting content slate with movies like Red Notice and Don’t Look Up and a new season of The Witcher, Netflix failed to grab the consumer’s attention.

Year-to-date, shares have already lost 14.9% value, compared to a 10.1% fall over the past year. Shares closed down 1.5% at $508.25 on January 20.

Weaker Than Expected Revenue and Subscriber Adds

Netflix’s Q4 revenue rose 16.1% year-over-year to $7.71 billion, but missed the analysts’ estimates of $7.72 billion. Compared to Q3, revenue grew 3.1%.

A key metric that translates the revenue earning capacity for the platform is its global paid streaming memberships. During the quarter, Netflix added 8.28 million global net subscription members, falling short of both the consensus estimate of 8.33 million and its guidance of 8.5 million net adds.

On a positive note, quarterly earnings came in better than expected at $1.33 per share, an 11.8% year-over-year gain, significantly higher than Street estimates of $0.82 per share. The Q4 earnings numbers included a $104 million non-cash unrealized gain from FX remeasurement on Euro-denominated debt.

The Q4 earnings per share (EPS) number is much lower compared to the stellar earnings of $3.19 per share reported in Q3, which drew from the success of shows like Squid Game.

For the full year fiscal 2021, revenue climbed 19% annually to $29.70 billion and earnings came in at $11.24 per share, significantly better than the FY20 number of $6.08 per share. In 2021, Netflix added 18 million paid subscriptions globally, compared to 37 million added in 2020.

Weak Q1 Forecast

In Q1FY22, Netflix forecasts earnings of $2.86 per share on revenue of $7.90 billion. Meanwhile, the consensus estimates are comparatively more bullish and are pegged at $3.45 per share on revenue of $8 billion. Moreover, in Q1, Netflix expects to add 2.5 million subscribers globally.

To increase its subscriber base and revenue stream, in December, the streaming giant slashed prices of its subscription plans pan-India. Meanwhile, just last week, it increased the prices of its U.S. and Canada monthly subscription plans.

Company Comments

In the shareholder letter, Netflix said, “Even in a world of uncertainty and increasing competition, we’re optimistic about our long-term growth prospects as streaming supplants linear entertainment around the world. We’re continually improving Netflix so that we can please our members, grow our share of leisure time and lead in this transition.”

Analysts’ Take

Responding to the results, Goldman Sachs analyst Erin Sheridan expressed concerns about investors’ negative reactions to the weak performance. According to Sheridan, Netflix delivered a “mixed picture” for subscriber growth and operating margin projections for 2022.

Moreover, the analyst states that NFLX stock has underperformed the market for the last 18 months but also agrees that there is no clarity on the post-pandemic normalized growth rates.

Sheridan reiterated a Hold rating on the stock with a price target of $580, which implies 14.1% upside potential to current levels.

Overall, the stock has a Moderate Buy consensus rating based on 16 Buys, 4 Holds, and 2 Sells. The average Netflix price target of $637 implies 25.3% upside potential to current levels.

Blogger Opinions

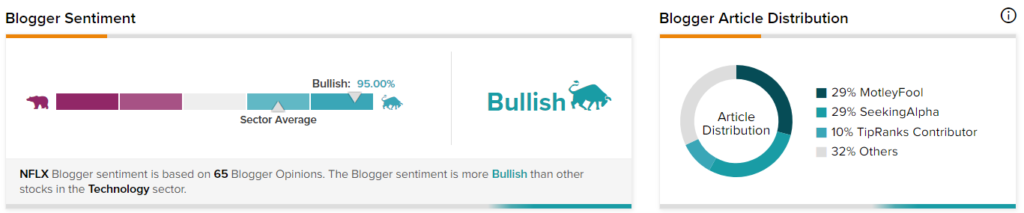

TipRanks data shows that financial blogger opinions are 95% Bullish on NFLX, which is one of the trending stocks today, compared to a sector average of 70%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Ford Discloses Special Items Impacting Q4 Results, $8.2B Gain from Rivian Stake

Alcoa Delivers Exceptional Q4 Earnings, In-Line Revenue

Bank of America Delivers Solid Q4 Earnings; Shares Up 5%

Questions or Comments about the article? Write to editor@tipranks.com