Streaming giant Netflix (NASDAQ:NFLX) successfully won a lawsuit filed by its shareholders, Reuters reported. This legal victory precedes the company’s upcoming Q4 financial results, scheduled for January 23.

According to the report, a Texas-based investment trust sued NFLX in May 2022, alleging that the company had concealed the extent to which account-sharing was impeding its growth. The decline in Netflix’s subscriber base during the early months of 2022 resulted in a significant drop in the company’s stock value. The lawsuit was filed to recover losses on behalf of investors who purchased Netflix shares between January 2021 and April 2022.

The court found that the case lacked sufficient evidence to support the investors’ claim that Netflix was aware of the problem. The judge suggested that the investor could refile the lawsuit if additional facts were presented to strengthen the allegations. While NFLX successfully defended itself, let’s delve into Q4 expectations.

NFLX’s Bottom Line to Get a Massive Boost in Q4

Wall Street analysts expect Netflix to benefit from the company’s implementation of its ad-supported tier as well as cracking down on password sharing. Analysts expect Netflix to report revenue of $8.71 billion in Q4, slightly higher than management’s guidance of $8.69 billion. Further, analysts’ forecast suggests sequential and year-over-year improvements of about 2% and 11%, respectively.

The increased revenue and reduced spending are expected to enhance its operating income, consequently benefiting its bottom line. Analysts expect Netflix to post earnings of $2.21 per share in Q4, compared to $0.12 in the prior-year quarter.

What is Netflix’s Stock Prediction?

Netflix stock has gained nearly 54% over the past year as the company’s crackdown on password sharing has significantly improved its paid member base. However, a significant increase in its paid member base in countries with lower ARPU (average revenue per user) and limited price increases has restricted company-wide ARPU growth.

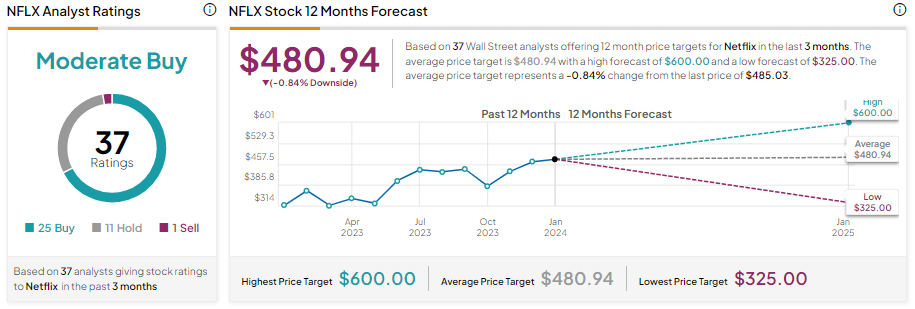

Thus, Wall Street is cautiously optimistic about Netflix stock ahead of Q4 earnings. With 25 Buy, 11 Hold, and one Sell recommendations, NFLX stock has a Moderate Buy consensus rating. Further, analysts’ average price target of $480.94 shows a downside potential of 0.8% from current levels.