The notion of an advertising-supported tier of service on streaming giant Netflix (NASDAQ:NFLX) has engendered quite a bit of debate, but it seems to be working. Now, Netflix is making a modification to that plan that will be a bit more forgiving to one of the philosophies that made it great: binge watching. And Netflix shares ticked up somewhat in Thursday afternoon’s trading, thanks in part to this modest change.

The change in question will be something of a relief for binge watchers, those who settle in to watch the entirety of a show—or even just a season—one episode after another in sequence. Multiple reports note that those who watch three episodes in a row of a series will be able to watch the fourth episode entirely without advertising. No ads. Just whatever you were watching, straight through to the end. Netflix also took the opportunity to repeat a point it had already revealed during its last earnings call: ad-supported downloads would also be coming soon, allowing advertisers to even reach those who were watching Netflix offline.

With the colder months of the year coming soon throughout the northern hemisphere, it’s no surprise that Netflix would gear up for more viewers. After all, hiding inside in the winter is practically a national pastime in some places. So for Netflix to voluntarily surrender some revenue to make a slightly better viewing experience will likely help it keep some of those newly-minted ad-supported tier viewers. Plus, reports note, advertisers will also have the ability to sponsor a show outright; popcorn brand Smartfood sponsored “Love Is Blind,” and both “The Crown” and “Squid Game: The Challenge” will have a similar setup.

Is Netflix a Buy, Sell or Hold?

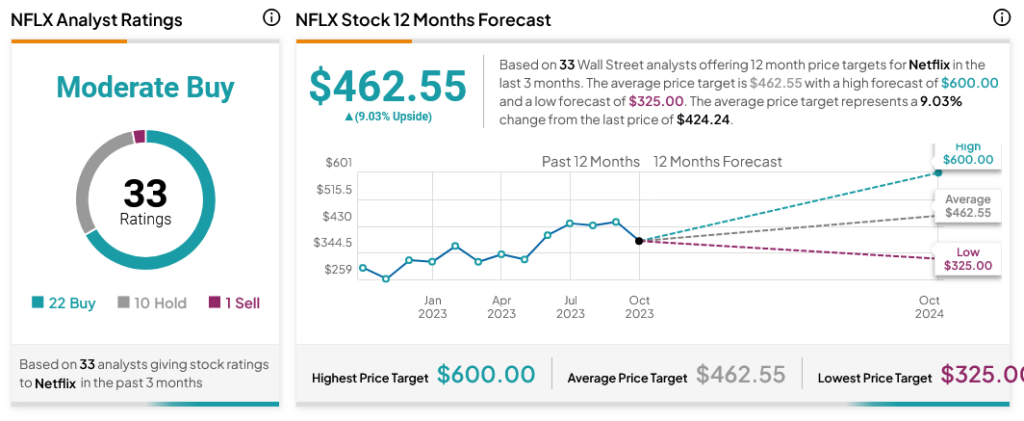

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 22 Buys, 10 Holds and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NFLX price target of $462.55 per share implies 9.03% upside potential.