Shares of NetEase advanced 2.3% in Thursday’s pre-market trading after its 3Q earnings of $0.79 per ADS (American depository shares) topped analysts’ estimates of $0.46. That compares to the year-ago earnings of $1.07 per ADS. The China-based internet and online game services provider’s 3Q revenues increased 27.5% to $2.7 billion year-over-year and was in line with the Street’s estimates.

NetEase’s (NTES) revenue growth was mainly driven by 20.2% increase in online game services net revenues. Youdao net revenues surged 159%, while innovative businesses and others net revenues grew 41.6% during the quarter and contributed to the top line.

NetEase’s CEO William Ding said that “The strength of our games business is bolstered by our diverse and growing game portfolio with impressive longevity. Additionally, our robust pipeline of games ready for launch is hugely exciting, and we cannot wait to unveil our game sensations across multiple genres to both domestic and global players in the coming quarters.” He added that “Our other businesses including Youdao, NetEase Cloud Music and Yanxuan are also on track, with promising year-over-year topline growth.” (See NTES stock analysis on TipRanks).

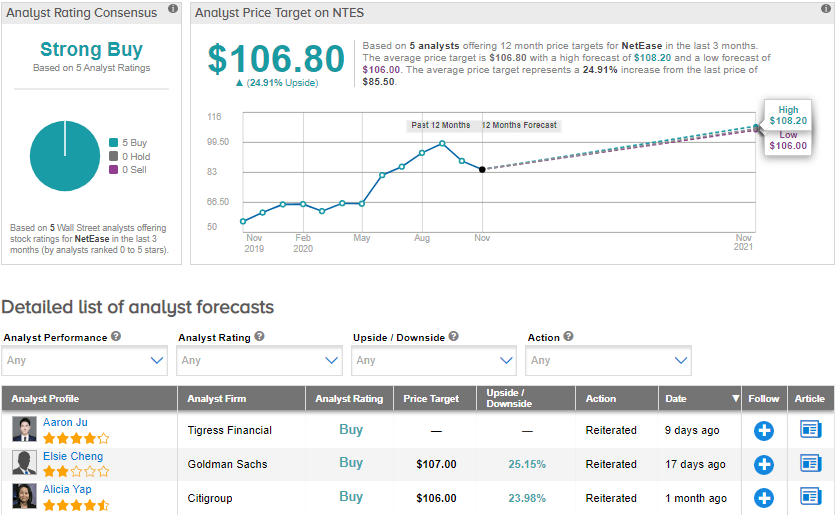

On Nov. 10, Tigress Financial analyst Aaron Ju maintained a Buy rating on the stock as he believes that “NTES still has a significant upside over the long-term.” Ju expects NetEase to continue to deliver sustainable revenue growth driven by “NetEase’s strong IP, the health of the gaming business and healthy momentum of its innovative business.”

Further, “NetEase’s ongoing development of Youdao Premium Courses will continue to boost a steady inflow of new users and enhance the user experience and customer loyalty for its online education business,” the analyst added. He also expects NetEase’s strong balance sheet and cash flow to continue to “fund its new product development, growth, and ongoing dividend increases.”

Currently, the Street has a bullish outlook on the stock with a Strong Buy analyst consensus. The average price target stands at $106.80 implying upside potential of about 25% to current levels. Shares have gained about 39.4% year-to-date.

Related News:

Baidu Surprises With 3Q Sales Driven By China Recovery; Street Bullish

JD.com Surprises With 3Q Profit; Street Sticks To Buy

Gan Drops 5% As 3Q Loss Widens; Street Sees 59% Upside