All eyes will be on the House of Mouse, The Walt Disney Co. (NYSE:DIS), as it is set to announce its Fiscal fourth quarter results today. This includes activist investor Nelson Peltz‘s Trian Fund Management that holds around $2.5 billion worth of Disney shares.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

According to a CNBC report, Trian will be watching Disney’s quarterly results closely before deciding whether it will go ahead to nominate new board members through a proxy fight. Peltz may also be looking for evidence that Disney’s move to slash 7,000 jobs earlier this year has improved its earnings.

The report stated that Peltz may ideally prefer to bypass the nomination process to the company’s Board, which could prove to be time consuming and expensive. Earlier this year, Peltz had tried to push for more Board seats, but was eventually rebuffed by the company’s current CEO, Bob Iger.

According to a company filing, shareholders can nominate directors for voting to Disney’s Board at its annual meeting between December 5 and January 4. If Trian does decide to move forward with the nomination process, it is likely that Peltz will “attack Disney’s sagging share price,” which is currently hovering near a yearly low.

Iger has stated earlier that the company is open to exploring options to sell its linear networks like ABC and is exploring strategic investment partners for ESPN.

Is Disney a Buy, Hold, or Sell?

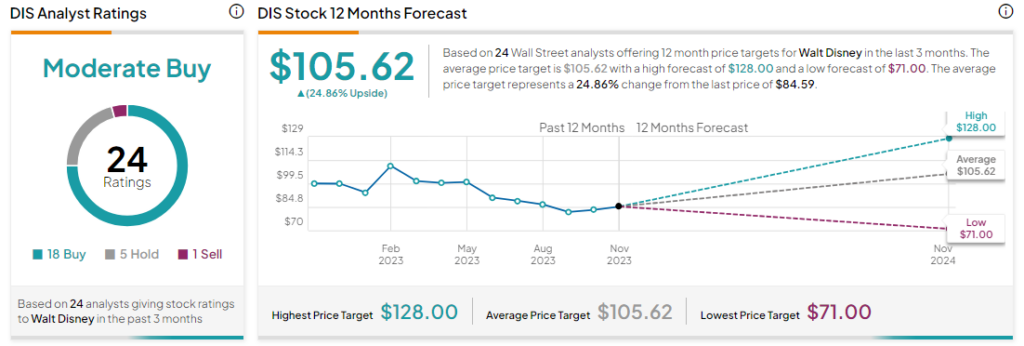

Analysts are cautiously optimistic about DIS stock with a Moderate Buy consensus rating based on 18 Buys, five Holds and one Sell. The average DIS price target of $105.62 implies an upside potential of 24.86% at current levels.