Nektar Therapeutics reported a better-than-expected loss in the fourth quarter but lagged analysts’ expectations for revenues. Shares of the biopharmaceutical company dropped almost 1.5% to close at $22.44 on Feb. 25.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Nektar (NKTR) incurred a loss of $0.65 per share in 4Q, compared to the $0.68 loss per share estimated by analysts. Total sales generated in the quarter amounted to $23.5 million, falling short of analysts’ expectations of $30.01 million.

The company’s research and development expenses were $102.7 million in the quarter, down 7% year-over-year. (See Nektar stock analysis on TipRanks)

Nektar CEO Howard W. Robin said, “This past year, Nektar made significant progress advancing our clinical pipeline of novel cytokine therapeutics.”

“For our PROPEL study, we look forward to reporting the first data for BEMPEG plus pembrolizumab in patients with metastatic non-small cell lung cancer in the second half of 2021,” Robin added.

On Feb.17, Nektar entered into an agreement with Merck (MRK), a pharmaceutical company, for a Phase 2/3 study of IL-2 pathway agonist, bempegaldesleukin, in combination with Merck’s KEYTRUDA (pembrolizumab) in patients suffering from squamous cell carcinoma of the head and neck (SCCHN). The study is likely to begin in the second half of 2021.

On Feb. 18, Mizuho Securities analyst Difei Yang maintained a Buy rating and a price target of $35 (56% upside potential) on the stock as the analyst doesn’t “see significant upside from the deal relative to potential future milestone payments.”

Yang expects “upcoming Phase 1/2 data in NSCLC and initial Phase 3 ORR data in melanoma as the key value drivers for NKTR shares in 2H21.”

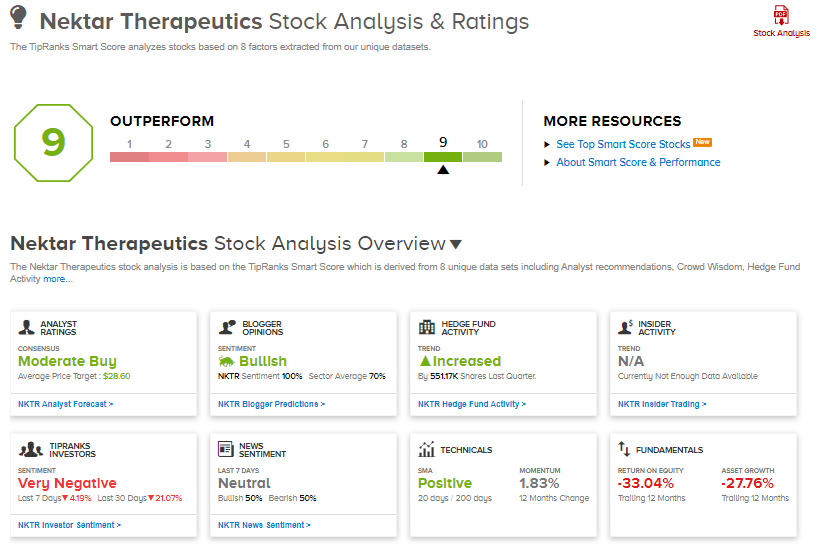

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 3 Buys and 3 Holds. The average analyst price target of $28.60 implies more than 27% upside potential to current levels. Shares have jumped 32% so far this year.

Nektar scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Analog Devices Posts Better-Than-Expected 1Q Earnings Amid Strong Chip Demand

Moody’s Posts Better-Than-Expected 4Q Revenue But Profit Disappoints

Lincoln Electric Posts Better-Than-Expected Quarterly Profit; Street Sees 5% Upside