Shares of Super Micro Computer Inc. (SMCI) have risen 54% year-to-date even after a 31% decline over the past month due to concerns about declining margins. Despite near-term pressures, Needham analyst Quinn Bolton initiated coverage of SMCI stock yesterday, calling it the “coolest kid in AI town.” The 5-star analyst assigned the stock of the artificial intelligence (AI) server maker a price target of $600, which reflects an upside potential of more than 37% from the current levels.

Needham Analyst is Bullish on SMCI’s Growth Prospects

Bolton believes that Super Micro Computer is a major beneficiary of the rapidly increasing investments in AI infrastructure, given that the company is the first mover in the design of GPU-based compute systems and liquid-cooled rack-level solutions. He expects the company’s revenue to grow at a CAGR (compound annual growth rate) of over 55% from Fiscal 2021 to Fiscal 2026. The analyst highlighted that SMCI headed into Fiscal 2025 with a record backlog and the company is currently a part of the deployment of some of the largest AI clusters in the world.

Last month, SMCI spooked investors when it reported a 430 basis points sequential drop in its gross margin for Q4 FY24 (ended June 30, 2024). The company blamed competitive pricing, an unfavorable product and customer mix, and higher initial costs associated with the ramping of the production of new DLC AI GPU clusters for the plunge in its gross margin.

Commenting on the gross margin concerns, Bolton said that while he has a more conservative view on gross margin recovery than management’s forecast, he thinks that the worries about the gross margin trending towards the single digit seem too pessimistic.

Overall, Bolton is upbeat about SMCI and the AI-led demand for its products. On TipRanks, the analyst is ranked 246 out of more than 9,000 analysts. He has a success rate of 56%, with an average return per rating of 14.4%.

Is Super Micro a Good Buy?

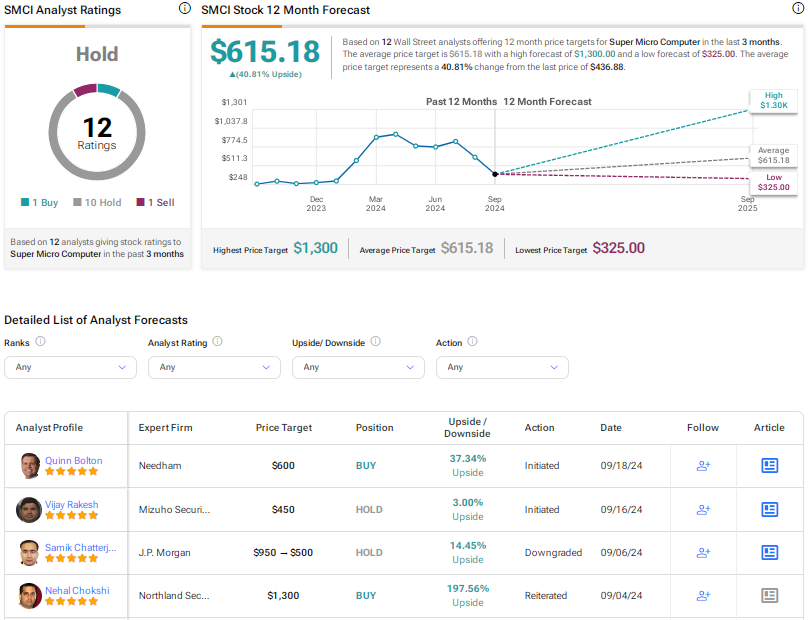

Wall Street is currently sidelined on Super Micro Computer stock amid gross margin pressures and the Board’s review of internal controls. SMCI stock has a Hold consensus rating based on 10 Holds, one Buy, and one Sell recommendation. The average SMCI stock price target of $615.18 implies 41% upside potential.