Navistar International said Volkswagen truck’s unit Traton ramped up its purchase offer for the US peer by 23% to $43 per share sending its stock up 13.8% on Thursday.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The buyout proposal for all outstanding shares of common stock of Navistar (NAV), not already owned by Traton was raised to $43 per share in cash from the $35 per Navistar share offered at the end of January. Traton currently holds 16.8% of Navistar’s outstanding common shares, which the German automaker bought in 2016.

“Navistar’s Board of Directors and management team are committed to exploring all avenues to maximize value. Consistent with its fiduciary duties, the Board will carefully review the revised proposal from Traton,” Navistar said.

The offer is still subject to a satisfactory due-diligence process as well as negotiation and a common understanding as regards the merger agreement. This merger agreement, which has yet to be worked out, is conditional on the final approval by the boards of Traton and Volkswagen AG, and by the Board of Directors of Navistar and the company’s stockholders.

“We continue to believe in the compelling strategic benefits that a complete merger of Traton and Navistar would produce,” said Traton CEO Matthias Gründler. “This is why we are re-emphasizing our interest in the transaction in spite of the Covid-19 pandemic.”

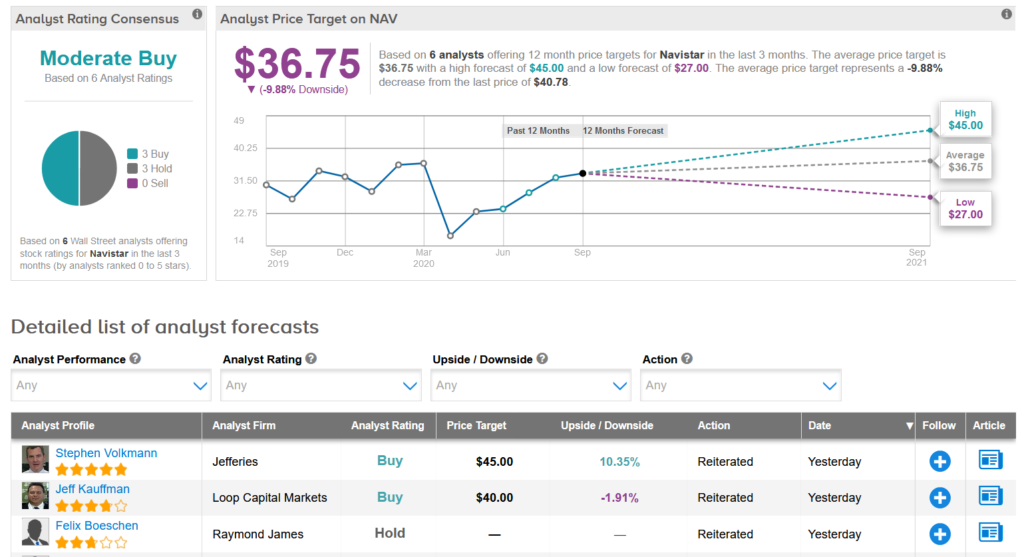

Shares in Navistar are up 41% so far this year, with the $36.75 average analyst price target suggesting almost 10% downside potential lies ahead.

For now, Raymond James analyst Felix Boeschen remains sidelined on the stock with a Hold rating.

“While we admire Navistar’s management, continued turnaround story and long-term profit improvement plan, we surmise NAV will remain largely in a “transition” phase through 2021,” Boeschen wrote in a note to investors. “Longer term, we believe NAV enjoys one of the most idiosyncratic opportunity sets, anchored by its 4.0 transformation, its alliance with Traton, and considerable runway for market share (re)-gains – all of which are likely to deliver demonstrable profit improvement in out years.”

However, “all said, for now, we see a balanced risk/reward with shares trading at ~20x+ our 2021 EPS estimate (given continued possibility for a TRATON takeover),” the analyst added.

The rest of the Street is cautiously optimistic on the stock’s outlook. The Moderate Buy analyst consensus is evenly divided between 3 Buys and 3 Holds. (See Navistar stock analysis on TipRanks)

Related News:

GM Snaps Up 11% Nikola Stake In Electric Trucks Partnership; Shares Soar

General Motors Plans To Jointly Develop Cars With Honda

Nio August Car Deliveries More Than Double