Truck maker Navistar International Corp. (NAV) has acquired a minority stake in TuSimple to co-develop self-driving trucks targeted for production by 2024.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Navistar and TuSimple did not disclose the size of the stake but said that the strategic partnership is the result of a successful technical relationship between the companies for more than two years.

The self-driving truck project between TuSimple, which specializes in autonomous vehicle technology, and Navistar seeks to develop a fully integrated engineering solution that will be ready for mass-production using Navistar’s vehicle manufacturing capabilities, the companies said in a joint statement. Customers will be able to purchase the fully autonomous trucks through Navistar’s traditional sales channels in the U.S., Canada and Mexico.

“Autonomous technology is entering our industry and will have a profound impact on our customers’ businesses,” said Navistar CEO Persio Lisboa. “Navistar’s strategic partnership with TuSimple positions us to be a leader in developing solutions for our customers by leveraging our organizations’ collective expertise to integrate our vehicle design and systems integration capabilities with TuSimple’s innovative autonomous technology.”

Navistar, a producer of brand commercial trucks, proprietary diesel engines, and school buses has a 113-year history of developing commercial vehicles and bringing them to the market. With this partnership TuSimple aims to innovate the $800 billion U.S. trucking industry by improving safety, increasing efficiency and significantly reducing operating costs, the company said.

Last December, TuSimple announced results of a study conducted at the University of California that showed that the company’s autonomous driving technology reduced fuel consumption in heavy-duty trucks by 10%. The San Diego-based company plans to build completely driverless operations in 2021.

It operates a fleet of 40 self-driving trucks in the U.S., shipping freight autonomously between Arizona and Texas for companies including UPS (UPS) and McLane Co., a unit of Warren Buffet’s Berkshire Hathaway.

Shares in Navistar rose 2.7% to $29.89 in morning U.S. trading and are now up 3.2% since the start of the year.

Longbow analyst Faheem Sabeiha last month cut Navistar’s rating to Hold from Buy after channel checks with several U.S. truck dealers pointed to a “sluggish recovery”.

The analyst sees “red flags” in specific markets segments where Navistar has meaningful exposure including construction, service vehicles for municipalities, and medium-duty trucks.

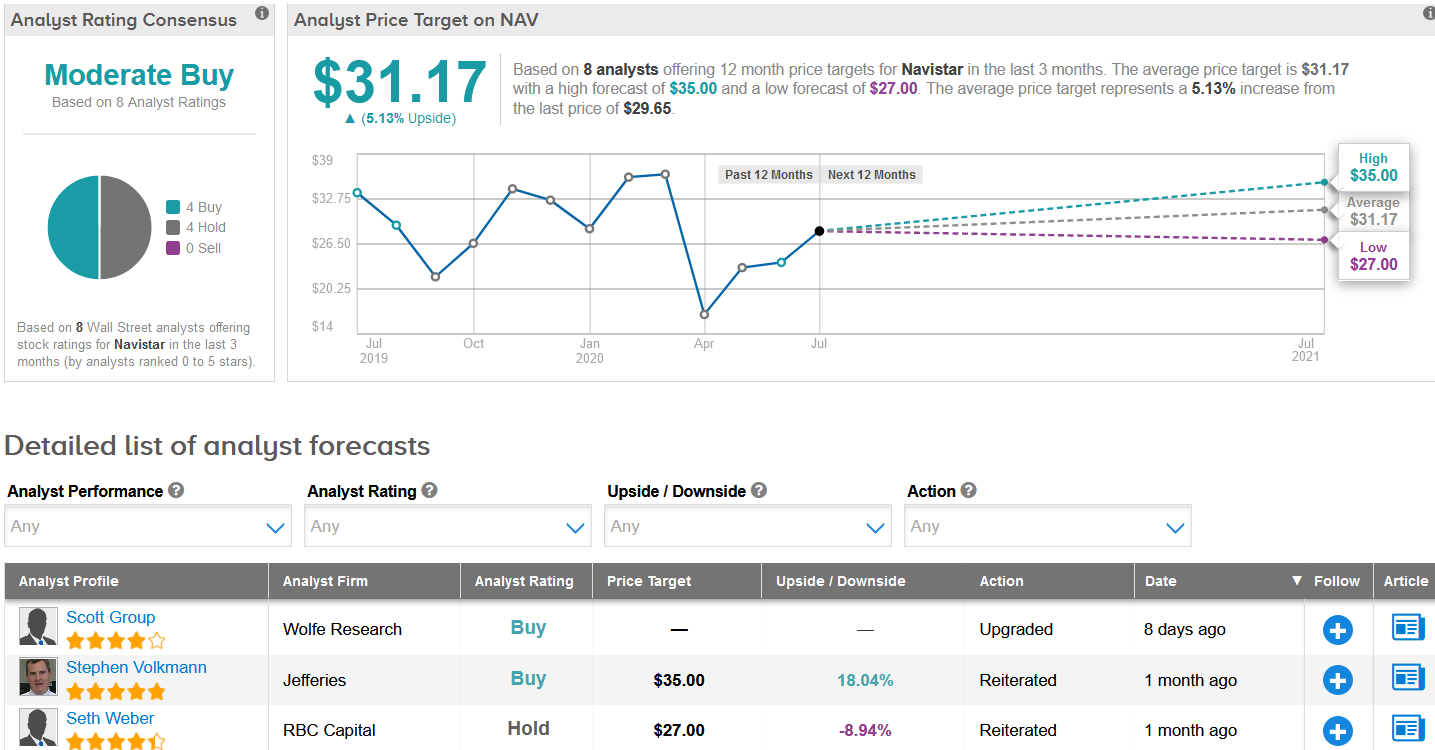

Following the recent share rally since the lows in March, Sabeiha does not see near-term catalysts to drive shares higher. Indeed, the $31.17 average analyst price target implies 5.2% upside potential in the shares in the coming 12 months. (See Navistar stock analysis on TipRanks)

The rest of the Street is cautiously optimistic on the stock’s outlook. The Moderate Buy analyst consensus is evenly divided between 4 Buys and 4 Holds.

Related News:

Medtronic To Buy Medicrea For About $154 To Bolster Spine Surgery Business

Tesla Climbs 6% In Pre-Market, Boosted By ‘Accelerating’ China Projects

Tesla’s Elon Musk Overtakes Buffett On Billionaires Rich List