Navient (NAVI) has entered into a deal with Maximus (MMS) to transfer all federal student loan accounts to Maximus. Following this, Navient will mark its exit from the federal student loan servicing program. The transfer is subject to regulatory approval.

Both the companies have consulted the U.S. Department of Education office of Federal Student Aid (FSA) and have been asked to submit a preliminary request for review. The contract novation is expected to be finalized in the quarter beginning October 1, 2021 and is subject to the consent of FSA. (See Navient stock chart on TipRanks)

As per the agreed terms, the transferred accounts will become a part of the FSA portfolio at Maximus, which includes the Debt Management and Collections System contract and the Next Generation Business Process Operations contract vehicle. Also, Navient’s employees working in the department would join Maximus. (See Maximus stock chart on TipRanks)

The President and CEO of Navient, Jack Remondi, said, “Navient is pleased to work with the Department of Education and Maximus to provide a smooth transition to borrowers and Navient employees as we continue our focus on areas outside of government student loan servicing.”

Two months ago, Wedbush analyst Henry Coffey reiterated a Buy rating on the stock and raised the price target to $25 from $19. The new price target implies upside potential of 11.9%.

The analyst remains optimistic about the company’s success at buying back stock and reducing debt.

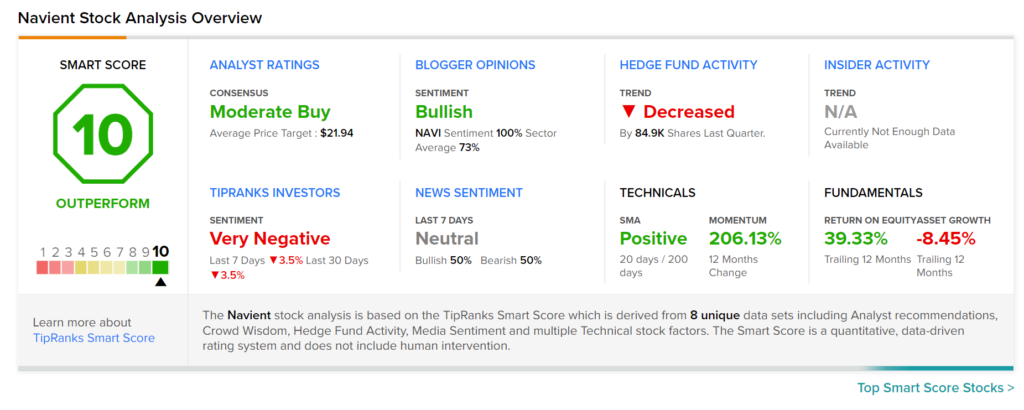

Consensus among analysts is a Moderate Buy based on 4 Buys and 4 Holds. The average Navient price target stands at $21.94 and implies downside potential of 1.8% from current levels.

Furthermore, Navient scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Micron Shares Fall 3.7% Despite Upbeat Q4 Result

United Natural Foods Hits New Record High, Exceeds Q4 Expectations

Thor Industries’ Shares Leap 8% on Stellar Q4 Beat