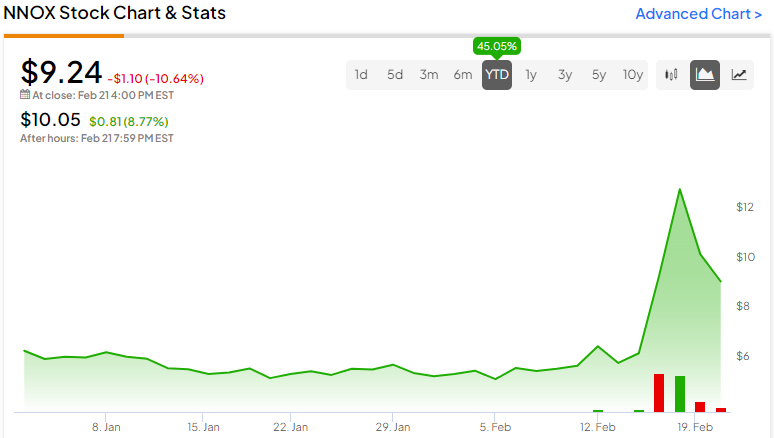

A surprising revelation caused a stir in markets last Wednesday. Nano-X Imaging (NASDAQ:NNOX), a medical device manufacturer from Israel, saw its share price skyrocket, quickly doubling and adding roughly $400 million in market value, thanks to chip giant Nvidia (NASDAQ:NVDA), which unveiled its investment in the company through a 13F filing with the SEC. However, NNOX stock seems to be settling down from the Nvidia-linked spike.

While Nvidia has owned a small amount of Nano-X for several years, this was the first 13F filing in which the semiconductor company disclosed stakes in several companies, causing the share price for most to jump, including NNOX.

About Nano-X

Based in Neve Ilan, Israel, Nano-X Imaging develops artificial intelligence (AI) technology for use in medical imaging applications. The company provides AI-based software imaging solutions to hospitals, health maintenance organizations, integrated delivery networks, pharmaceutical companies, and insurers.

Nano-X’s applications are designed to identify or predict undiagnosed or underdiagnosed medical conditions through the mining of data included in images of existing computed tomography scans for osteoporosis and cardiovascular disease.

Most recently, the company received FDA Clearance for HealthFLD, an advanced AI-based software solution aimed at assisting clinicians in assessing fatty liver, which is an early sign of metabolic dysfunction-associated steatotic liver disease (MASLD). The opportunity in this market is quite significant as an estimated 24% of U.S. adults are living with MASLD.

More to the Story

NNOX is no stranger to stock volatility, frequently caught in the tug of war between long buyers and short sellers. But this time, it’s the role options played that’s raising eyebrows.

On February 12, trading of call options, contracts that let you buy a specific security at a set price by a certain date, saw a jaw-dropping twelve-fold increase in volume compared to the six-month daily average, as noted by a Financial Times report. The report highlighted the spike in options volumes for Nano-X and SoundHound (NASDAQ:SOUN) ahead of the disclosure of Nvidia’s stake in these companies.

Notably, investors snagged contracts for just $0.04 to $0.30 despite them expiring in just a few days. Several days later, those same contracts were changing hands at prices as high as $6.40, marking a staggering increase of almost 16,000 percent.

What is the Forecast for NNOX?

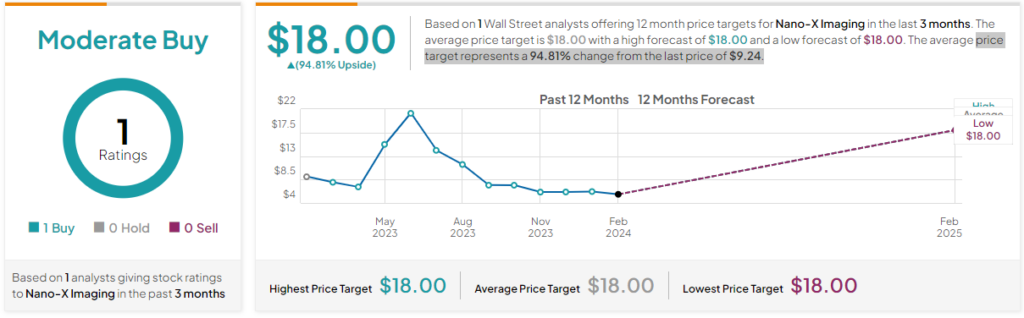

Perhaps a bit lost in all the excitement was Cantor Fitzgerald analyst Ross Osborn’s reiteration of a Buy rating and an $18 price target for NNOX. That price target represents a 94.81% change from the last price of $9.24. The stock is currently rated a Moderate Buy.

Final Analysis

The surge in Nano-X Imaging’s stock price may have been short-lived, and the involvement of Nvidia certainly played a role. Still, it is clear that there is growing interest in Nano-X and its innovative technology.

As with any volatile stock, however, investors need to be cautious and conduct their own thorough research before making any investment decisions, something admittedly made more difficult by the sudden spike in options trading.

Ultimately, only time will tell what lies ahead for Nano-X Imaging and its shareholders. But one thing is for sure – this relatively unknown company has gained widespread attention, thanks to its partnership with a tech giant like Nvidia. Whether or not they can capitalize on this momentum remains to be seen.