Shares of MyoKardia are soaring about 60% in Monday’s pre-market trading after the biopharma company agreed to be acquired by Bristol Myers Squibb in a cash deal valued at $13.1 billion. Bristol Myers’ shares are down 1.2% in pre-market trading. The deal was unanimously approved by both the companies’ board and is anticipated to close in the fourth quarter.

Bristol Myers Squibb (BMY), a developer of biopharmaceutical products worldwide, expects to finance the acquisition with a combination of cash and debt. Further, the deal is expected to be minimally dilutive to Bristol Myers Squibb’s adjusted earnings per share in 2021 and 2022 and will be accretive beginning in 2023, the company said.

Through the transaction, Bristol Myers gains MyoKardia’s (MYOK) experimental Mavacamten, used for the treatment of obstructive HCM (hypertrophic cardiomyopathy), which is a chronic heart disease.

Bristol Myers’ CEO Giovanni Caforio said that Mavacamten has “the potential to address a significant unmet medical need in patients with cardiovascular disease.” He also said that the acquisition would strengthen its cardiovascular franchise and “is expected to add a meaningful medium- and long-term growth driver.” (See BMY stock analysis on TipRanks)

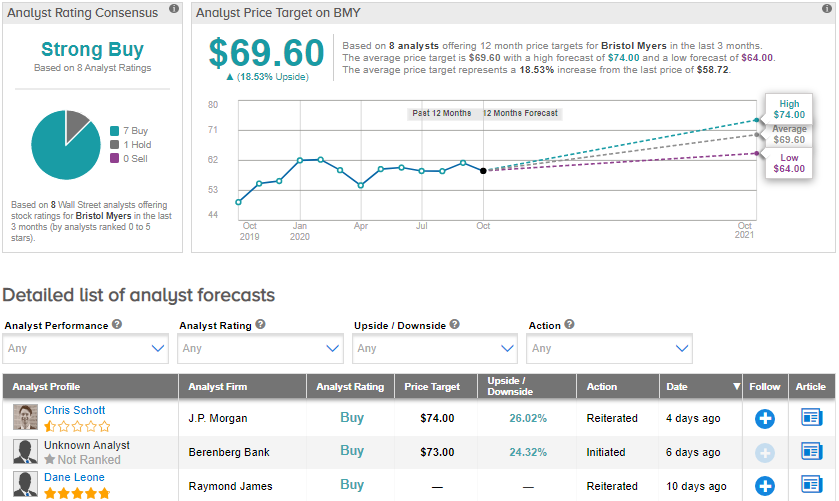

On Oct. 1, J.P. Morgan analyst Chris Schott reiterated his Buy rating on BMY stock with a price target of $74 (26% upside potential) as he believes that the shares are “increasingly well positioned” as Phase 3 data from the oral TYK-2 [tyrosine kinase 2] BMS-986165 inhibitor in psoriasis are expected in Q4. Schott sees “clear upside” if the Phase 3 safety is consistent with Phase 2.

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 7 Buys and 1 Hold. The average price target of $69.60 implies upside potential of about 18.5% to current levels. Shares are down about 8.5% year-to-date.

Related News:

BlackLine Buys Rimilia For $150 Million; Analyst Says Hold

Noble Energy Gets Shareholder Nod For $4.1B Chevron Deal

Zynga Closes Deal To Buy Game Developer Rollic