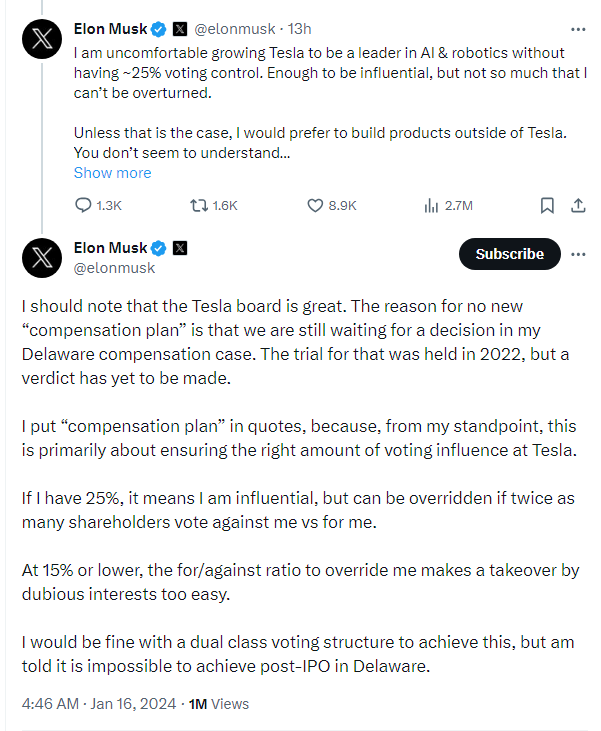

In a series of posts on social media platform X, EV major Tesla’s (NASDAQ:TSLA) CEO, Elon Musk, stated on Monday that he would like more voting control in the company before making Tesla a leader in artificial intelligence and robotics.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Musk explained that he wanted a 25% voting control in the company, nearly double his current stake.

Musk tweeted on the social media platform X that unless there was an increase in his voting control in Tesla, which was “enough to be influential, but not so much that I can’t be overturned,” he would prefer to build products elsewhere. Despite Musk highlighting Tesla’s partially automated “Full Self-Driving” software and its humanoid robots like Optimus, most of the company’s revenues come from cars.

Musk currently holds a 13% stake in Tesla and suggested in a separate post on X that to achieve a 25% voting control, he was fine with a dual-class share structure but was told that it was impossible after Tesla’s initial public offering (IPO). He commented, “It’s weird that a crazy multi-class share structure like Meta has, which gives the next 20+ generations of Zuckerbergs control, is fine pre-IPO, but even a reasonable dual-class is not allowed post-IPO.”

Dual-class structures in companies involve shares with disparate voting rights, typically favoring founders or early investors with greater influence and allocating less voting power to other shareholders.

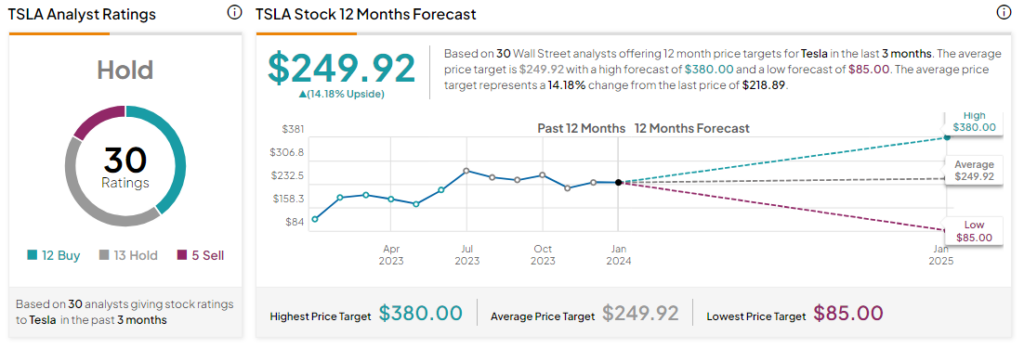

Is TSLA a Buy?

Analysts remain sidelined about TSLA stock with a Hold consensus rating based on 12 Buys, 13 Holds, and five Sells. Over the past year, TSLA stock has surged by more than 60%, and the average TSLA price target of $249.92 implies an upside potential of 14.2% at current levels.