Tesla (NASDAQ:TSLA) supremo Elon Musk has called on Warren Buffett to invest in the EV maker. In a reply to a user’s post on X (formerly Twitter), Musk noted that Buffett should pick a stake in Tesla and that it’s an obvious move. However, the conservative way in which things operate at Buffett’s Berkshire Hathaway (NYSE:BRK.B), compared to the rollercoaster that is Tesla (and Musk), makes one wonder if it is such an obvious move after all.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mixed Reviews on Elon Musk

Firstly, Buffett, alongside the late Charlie Munger, transformed Berkshire Hathaway from a struggling operation into a thriving conglomerate with diverse interests. The company is renowned for acquiring entities with robust business moats. Moreover, Buffett has fostered strong relationships with the owners of businesses Berkshire invests in or acquires, contributing to the company’s substantial cash reserves, which stood at $189 billion at the end of Q1.

In contrast, Musk has a history of conflicts with investors and partners. His departure from PayPal, the abandonment of a $56 billion payday at Tesla, and recent demands for a higher stake in Tesla illustrate this.

Nevertheless, Musk is also known for pulling off spectacular feats, and Buffett beginning to gobble up Tesla stock remains a possibility at the least. In the past, Musk has received praise from Berkshire, with the late Charlie Munger noting that Tesla’s achievement in the car business was a minor miracle. During Berkshire’s annual meeting on Saturday, Buffett noted that Tesla could achieve lower costs and prices if the automaker manages to lower car accidents through automation.

BYD Over Tesla

Notably, Buffett has a position in Chinese EV maker BYD (OTC:BYDDF) (HK:1211) but not Tesla. In the past, Musk had invited Buffett to invest in Tesla when the automaker was valued at just $7 billion. Its current market capitalization stands at around $577.8 billion.

What Is the Stock Price Forecast for Tesla?

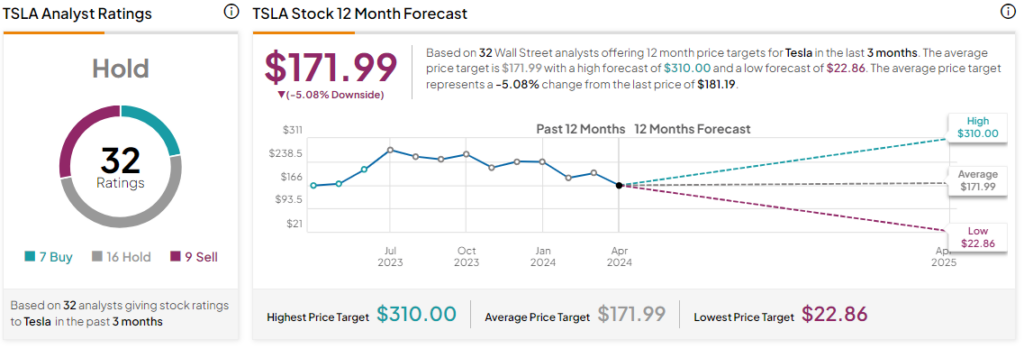

For now, though, Tesla’s share price is languishing nearly 27% lower year-to-date. Overall, the Street has a Hold consensus rating on the stock, alongside an average TSLA price target of $171.99.

Read full Disclosure