More than a dozen investors have joined Elon Musk in his efforts to purchase Twitter (TWTR) and take it private. Twitter shares rose about 2.7% on May 5, to close just above $50. Musk agreed to acquire the social media company for $54.20 a share. While Twitter stock edged up, Tesla (TSLA) fell more than 8%. Musk is the CEO of electric vehicle (EV) maker Tesla.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Oracle’s Larry Ellison Bets $1 Billion on Twitter

A group of about 19 investors has agreed to contribute about $7.14 billion to Musk’s Twitter buyout bid. The investors include Larry Ellison, the billionaire founder of software giant Oracle (ORCL), who is investing $1 billion. The other major investors in the arrangement are Sequoia Capital, with $800 million; VyCapital, with $700 million; and crypto exchange operator Binance, which is writing a $500 million check to Musk.

Saudi Prince al-Waleed bin Talal, who initially criticized Musk’s Twitter buyout bid, has changed his mind and is now supporting the deal. The Prince is backing the deal with his nearly 35 million shares in Twitter.

Musk Gets Loan Burden Relief

The contribution of the outside investors means that Musk will now rely less on loans to fund the Twitter takeover. Musk had initially arranged for a $12.5 billion margin loan with his Tesla shares as collateral.

With the financing commitment from the outside investors, the loan has been reduced to $6.25 billion. That would lessen the burden for the Tesla boss. The whole financing arrangement for the Twitter buyout should be a relief to Tesla investors also, since Musk may only need to pledge or sell a smaller amount of Tesla’s shares.

Musk agreed to purchase Twitter for $44 billion in cash. His goal is to transform the company privately, with a focus on content moderation issues and expanding revenue streams beyond advertising. Musk could take Twitter public again once he has changed the social media company to his liking.

Wall Street’s Take

The stock has a Hold consensus rating based on three buys, 27 Holds, and two Sells. The average Twitter price forecast of $50.76 implies the stock is fully valued.

Blogger Opinions

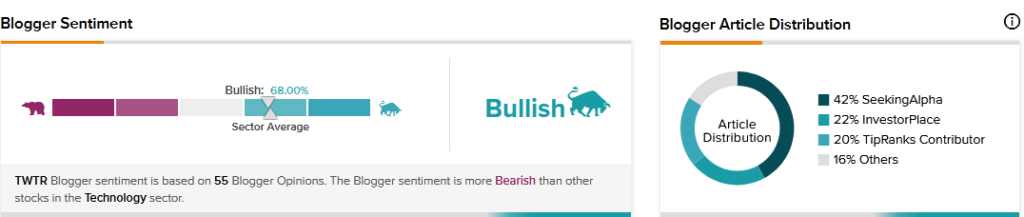

TipRanks data shows that financial blogger opinions are 68% Bullish on TWTR, which matches the sector average.

Key Takeaway for Investors

Musk’s history of not always following through with his plans had sowed doubts about him actually completing the Twitter takeover. For example, there were concerns that he could back out of the deal and instead pay the $1 billion breakup fee. However, the latest financing commitment further indicates that Musk is actually serious about closing the transaction. With Twitter stock rising to trade close to the buyout offer, the market seems to be betting that the deal will actually close.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Occidental Petroleum Marks a New High on Buffett’s Buy

What Pushed SIMO Stock 17.2% Up on Thursday?

Caterpillar Paves the Way for Sustainable Future